- Monthly Metals Mining Rundown - Free

- Posts

- Monthly Metals Mining Rundown for Month Ending 1 Aug 2025

Monthly Metals Mining Rundown for Month Ending 1 Aug 2025

Lithium price and stocks led among the metals & miners during July, even after last week's major losses; Palladium, silver, and gold prices also gained, along with most stocks in those mining peer groups.

This past month’s metal price and top & bottom mining company peer group movers include:

1 Aug 2025

1 Aug 2025

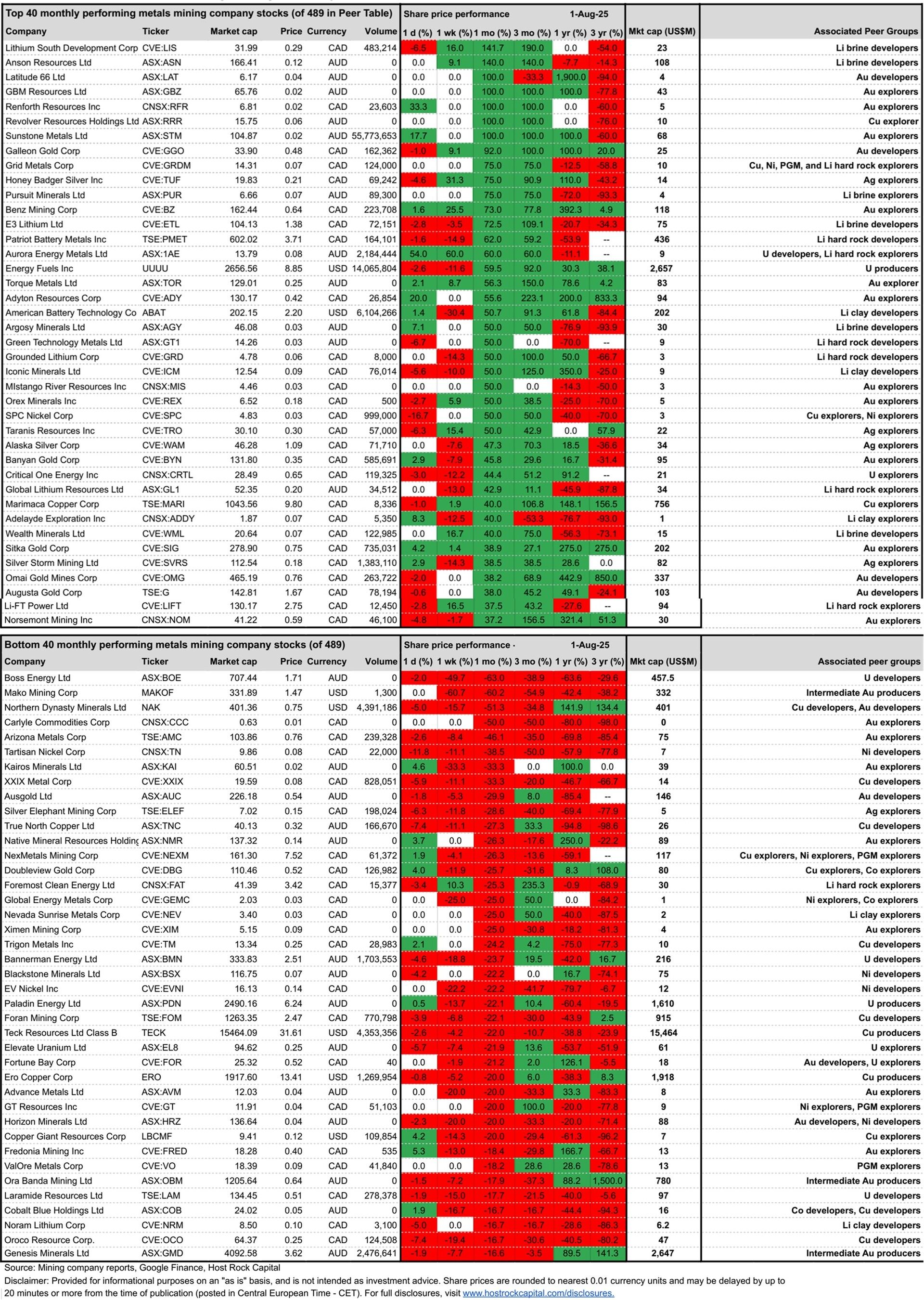

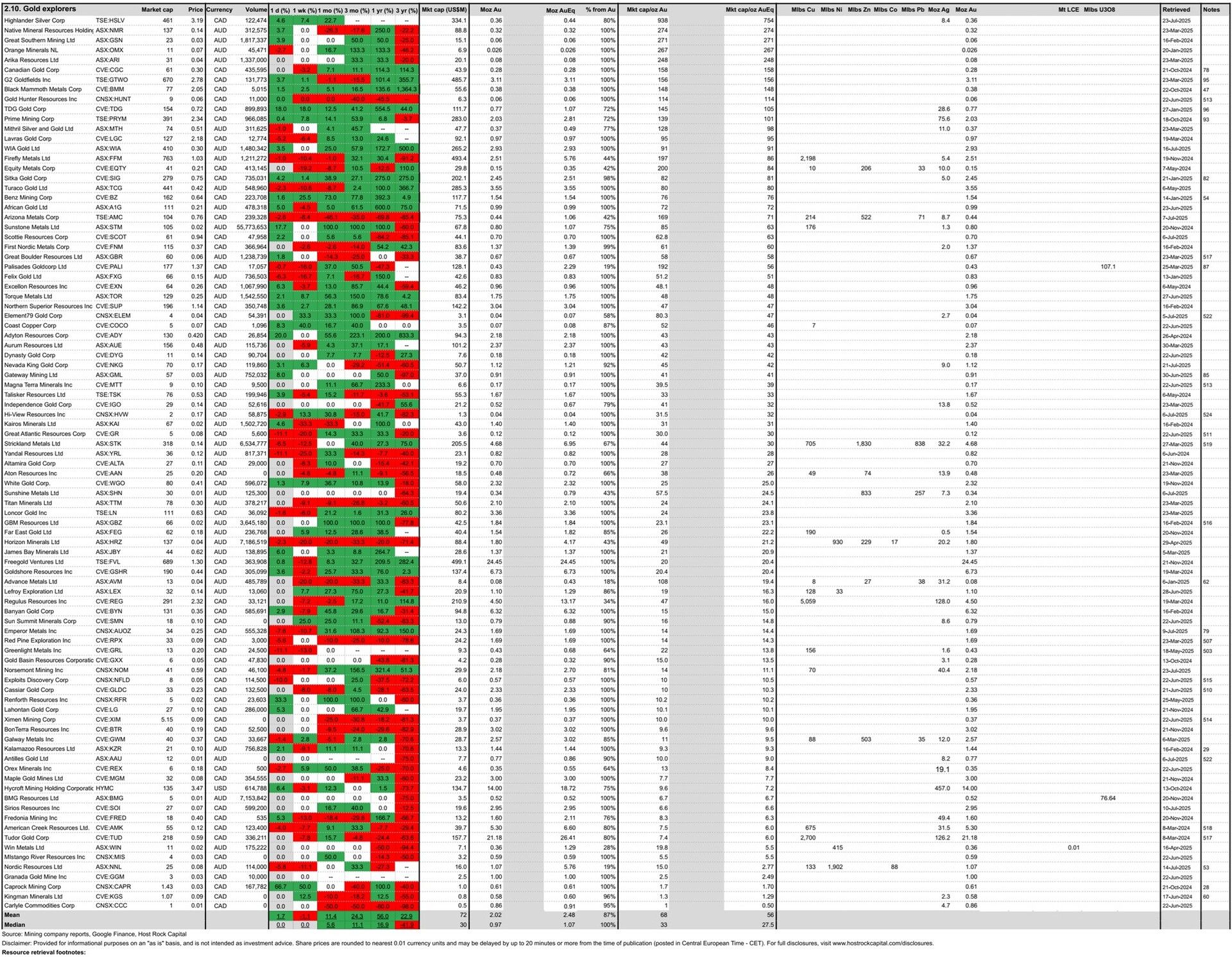

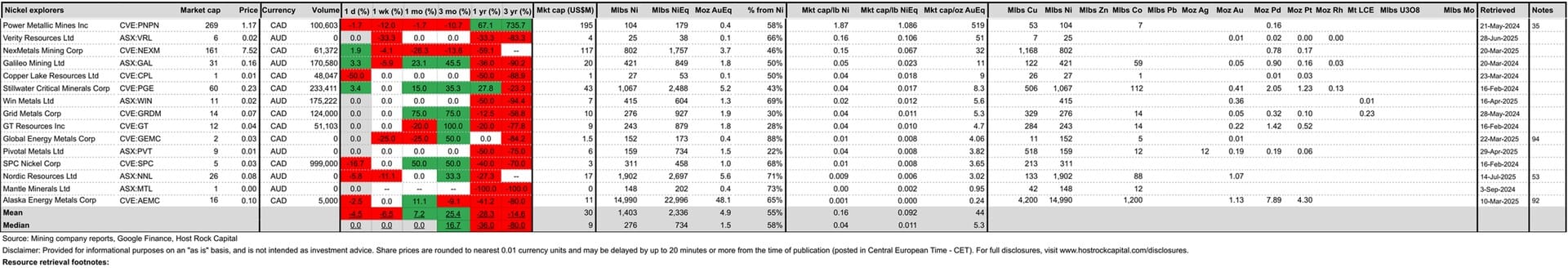

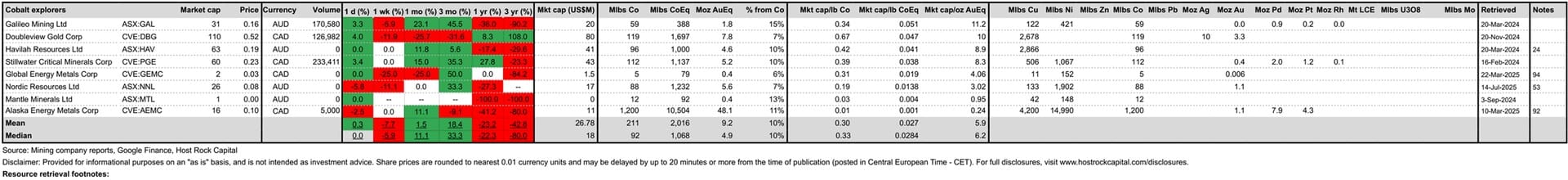

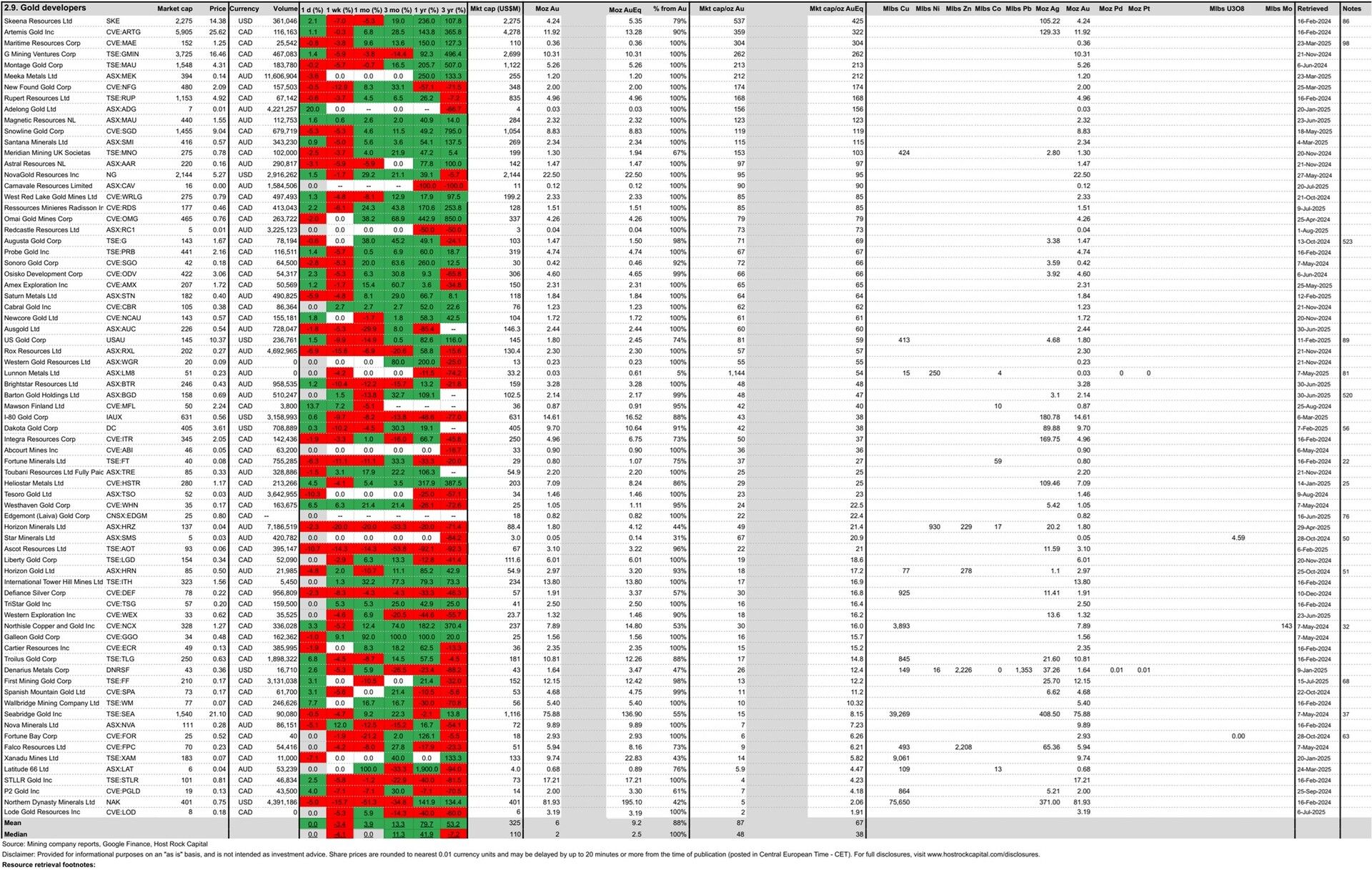

This past month’s top & bottom 40 performing metals mining stocks (out of Peer Table’s 489) include (share price rounding errors apply, as sourced from Google Finance):

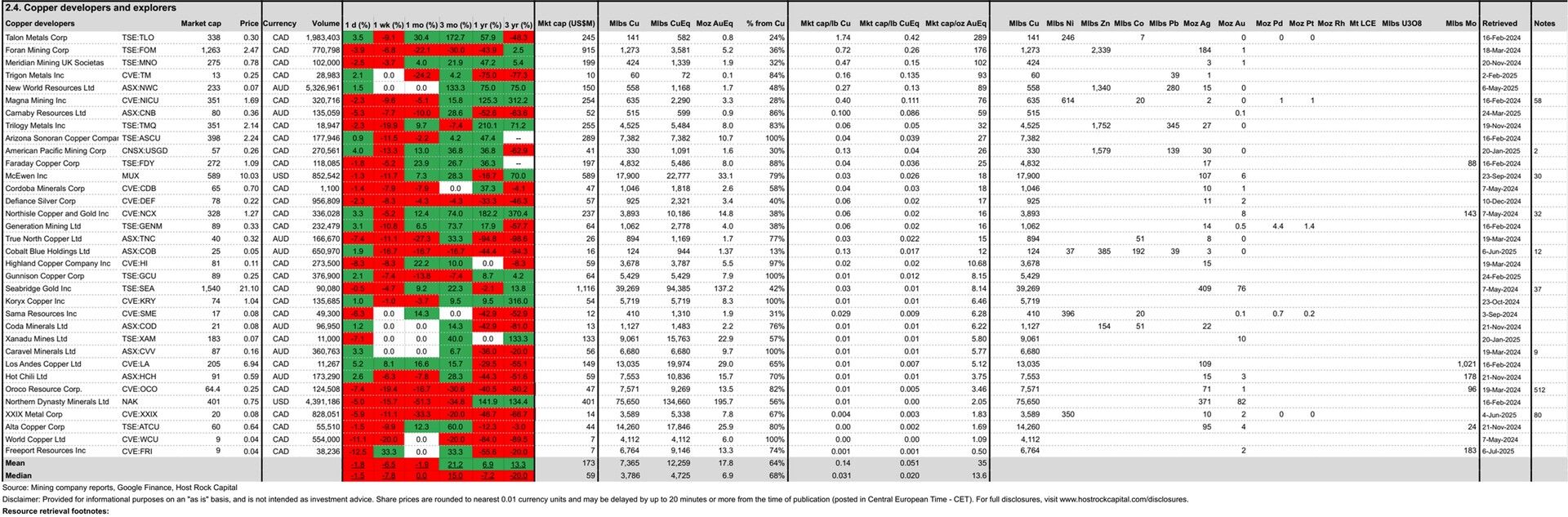

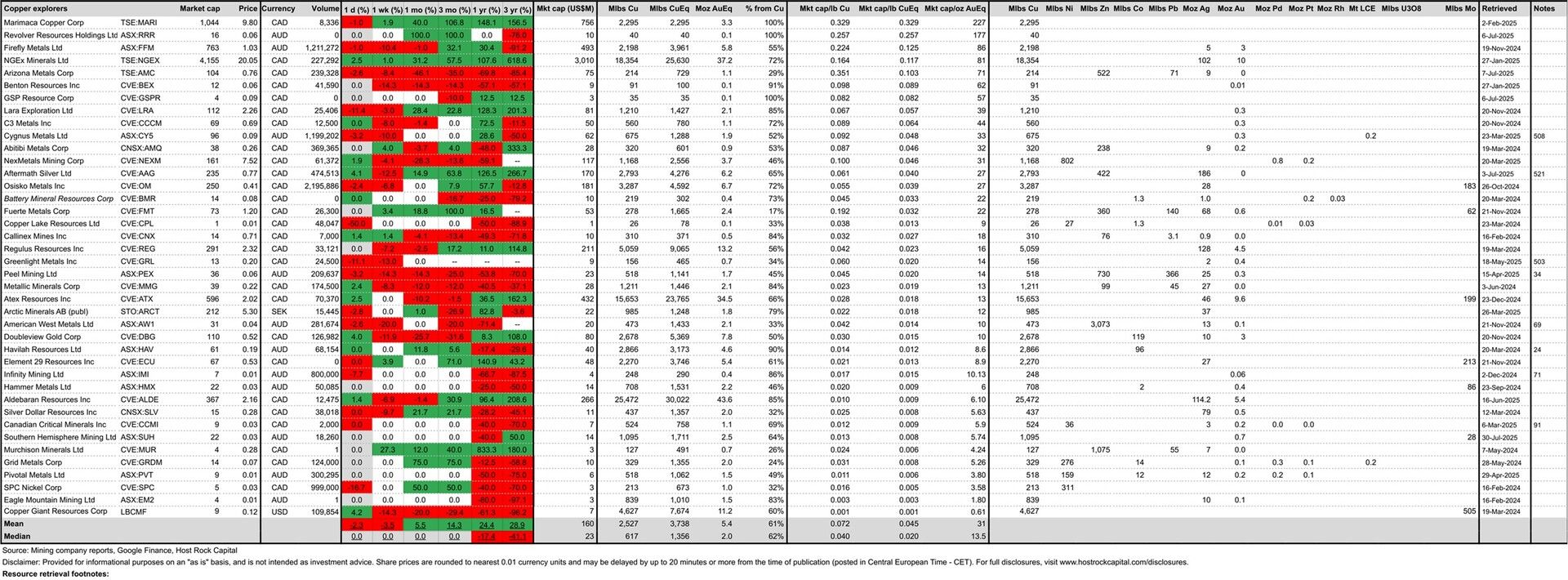

Coverage of metals mining announcements incorporated into this month’s Peer Table (resource updates, economic studies, changes in attributable project ownership) include:

28 July 2025 - Intermediate gold producer Torex Gold Resources Inc (TSX:TXG) announced the acquisition of gold explorer Prime Mining (TSX:PRYM) along with its multi-million ounce Los Reyes gold-silver project in Mexico in an all-stock deal, which adds a quality near-development/advanced-exploration stage asset to TXG’s diverse Mexican portfolio that already includes production of gold, silver, and copper. PRYM shareholders are to receive a 32.4% premium to 30-day VWAP and TXG will issue roughly 10.5m shares to proforma shares of 96.71m (dilution of ~12%) to add PRYM’s 2.8 Moz AuEq (77% Au, 23% Ag) at our estimated 3-month trailing average metal prices, which grows TXG’s resources by a substantial 32% to 11.6 Moz AuEq (74% from Au, 13% Cu, 13% Ag). TXG stock closed the month ending 1 Aug down -7.5% (vs. int. gold producer median loss of -1.8%) to a pro-forma market cap/oz AuEq resource of US$236/oz, which has been reduced by this deal to just below our 55-company intermediate gold producer mean market cap/oz of $242/oz AuEq.

1 Aug 2025

1 Aug 2025

27 Jul 2025 - Intermediate gold producer and copper developer McEwen Inc. (NYSE:MUX) announced the acquisition of gold explorer Canadian Gold Corp (TSXV: CGC) in all-stock deal, along with its past-producing Tartan Lake gold mine project, for which MUX has better funding capacity to advance through development. MUX gets Tartan’s starter resources of ~0.3 Moz including a high-grade 0.24 Moz @ 6.3g/t in the indicated category. CGC shareholders get a 26% premium to VWAP and are set to receive 0.0225 MUX shares for each CGC share, and are set to own 8.2% of combined company. MUX’s basic shares outstanding to increase from Google Finance’s 54m, to 58.7m proforma. MUX shares were down -12% over past week (ending 1 Aug) vs. intermediate gold producer median down -8%, and MUX is up +7.3% over past month ending 1 August (vs. int. gold producer median loss -1.8%) to MUX share price US$10.03, pro-forma market cap $589m or (proforma) market cap/oz resource of $18/oz AuEq for its ~33Moz AuEq resources - for a 89% discount to our 55-company intermediate gold producer median $167/oz (MUX market cap/oz for its 6Moz gold only excluding copper is $98/oz Au - still a 41% discount to int gold producer median $167/oz). Against copper developer peers (MUX is actually a producer), MUX trades at US$0.026/lb CuEq ($18/oz AuEq) - just above our 34-company copper developer group median US0$0.20/lb CuEq ($14/oz AuEq) and well below mean $0.051/lb CuEq ($35oz AuEq). CGC stock traded down -3% over past week (ending 1 Aug) vs. 92-company gold explorer mean loss of -1%, and up +7.1% over past month (ending 1 Aug) vs. gold explorer median gain of +5.6% to C$0.30/sh, market cap C$61m or US$158/oz Au (vs. gold explorer mean $56/oz AuEq).

1 Aug 2025

29 July 2025 - Former lithium hard rock explorer - now lithium hard rock developer - Wildcat Resources (ASX:WC8) announced results of a PFS for its 100%-owned Tabba Tabba project in Western Australia, confirming potential for a long-life mine with a post-tax NPV8 of A$1.2b at broker consensus spodumene (6%) price of US$1,384/t spodumene from pre-production capital of A$687m. While we only NAVs for Li hard rock developers with commodities lithium carbonate or hydroxide as a product, WC8’s resources of ~1.8 Mt LCE (~5.1 Moz AuEq) trade at a 1 Aug WC8 market cap/t of US$71/t LCE ($25.5/oz AuEq) - a 20% discount to our 17-company lithium hard rock developer peer group median $89/t LCE (US$32/oz AuEq).

1 Aug 2025

30 July 2025 - Copper explorer Southern Hemisphere Mining Limited (ASX:SUH) announced an updated JORC resource estimate of 218 Mt grading 0.38% CuEq for 496,600 t Cu (1.1 Blbs Cu), which included significant conversion to measured and indicated category now amounting to 174Mt grading 0.24% Cu and 0.10% Au. SUH stock traded up +3.5% on 30 July following this news to ~A$0.03/sh (vs. 40-company copper explorer mean daily performance of +1.4%), before closing the month (ending 1 Aug) flat +0% (in-line with group median flat +0%) at a market cap A$22m, and market cap/lb resource of US$0.008/lb CuEq ($5.3/oz AuEq) - a 60% discount to copper explorer median $0.020/lb CuEq ($13.5/oz AuEq).

1 Aug 2025

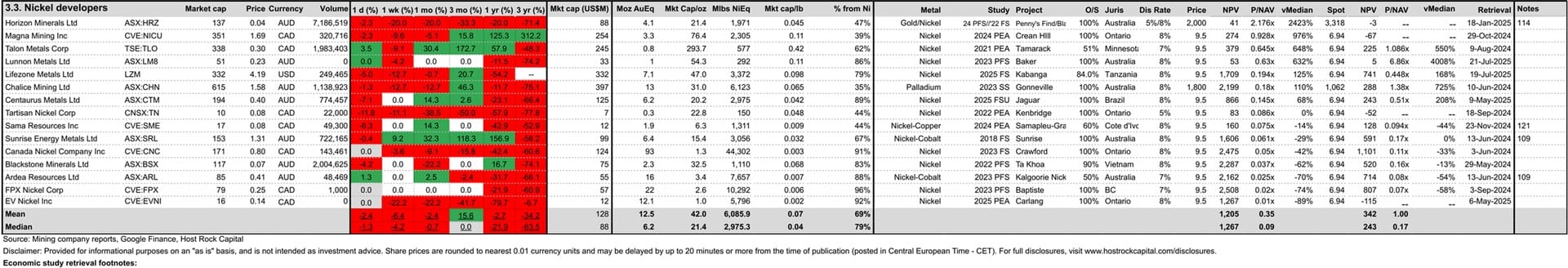

21 July 2025 - Nickel and gold developer Lunnon Metals Ltd (ASX:LM8) announced scoping study results for its Baker and Foster nickel sulphide project, serving as an update to prior 2023 PFS that incorporated only the Baker deposit. The study slightly improved the NPV relative to 2023 PFS, but most notably is it turned the NPV positive for current spot nickel price. LM8 stock closed the month ending 1 Aug flat +0% in-line with nickel developer group median also flat +0%, at a P/NAV (taken as market cap/70% of pre-tax NPV) of 0.65x at our reference nickel price of US$9.5/lb - just above the upper-quartile-range of our 15-company nickel developer peer group whose mean is 0.37x at same reference nickel price - for LM8’s super high-grade nickel assets with the majority of resources grading in 3-4% Ni range (plus lower grade Cu grading 0.15-0.50 % Cu and Co grading 0.05-0.10% Co).

1 Aug 2025

21 July 2025 (after-market) - Former gold explorer - now gold developer - New Found Gold Corp. (TSXV:NFG) announced PEA results for the AFZ Core zone of its 100%-owned 2Moz Queensway project in Newfoundland. The study reported a post-tax NPV5 of C$743m at US$2,500/oz Au from initial capital (for phase 1 toll milling plus phase 2’s 2.5 mtpa mill) of C$597m and 15-yr LOM AISC of US$1,256/oz Au. NFG closed 21 July (before this study was announced) at share price C$2.24/sh, before closing the month (ending 1 Aug) +8.3% (vs. gold developer median flat +0%) at a share price of C$2.09, market cap C$480m, market cap/oz resource of US$174/oz Au (just above the upper quartile range of our 72-company gold developer peer group, whose mean is US$66/oz) for this still-new-and-growing deposit that is 80% open pittable with relatively high open pits grade around 2g/t Au. On P/NAV according to this PEA, taken as market cap/post-tax NPV at our recent spot gold price of $3,318/oz, NFG trades (1 Aug) at 0.33x (similarly just above the upper-quartile range of gold developer peer group whose mean P/NAV is 0.15x at same recent spot gold price).

18 July 2025 - Nickel and Cobalt developer Lifezone Metals (NYSE:LZM) made two separate announcements: Filing of feasibility study (FS) for flagship Kabanga project in Tanzania, and further consolidation its ownership in the project to 84% from 69.7% according to a definitive agreement with BHP Bilton UK, with the remaining 16% of project being held by the Tanzanian government. The feasibility study further de-risks this top tier nickel developer and replaces the recent 2025 IACF (Initial Assessment of Cash Flows) in our Peer Table. LZM’s attributable after-tax NPV (at our reference nickel price of US$9.5/lb according to the metal price sensitivity provided in the FS) was US$1.7b, which trades at a 1 Aug P/NAV (market cap/attributable post-tax NPV) of 0.19x - just above nickel developer median 0.09x and still well below mean 0.35x (also at our reference nickel price of $9.5/lb).

1 Aug 2025

17 July 2025 - Gold developer Carnavale Resources (ASX:CAV) announced a resource update for its flagship Kookynie gold project in West Australia, which grew contained gold ounces by 38% to 117 koz Au (grading fairly high at 4.3 g/t) which are split between an open pit portion and an underground portion, and include a bonanza zone of 55 koz grading 28.3g/t Au. The update paves the way for an updated scoping study due in the coming weeks. CAV and its 117 koz resources trade at a month ending (1 Aug) market cap of A$16m and market cap/oz resource of US$90/oz Au, which is around the upper quartile range (~75-percentile) of our 71-company gold developer peer group. On P/NAV (taken as market cap/70% of pre-tax NPV) according to the results of the (now superseded) 2024 Scoping Study that was based on the initial resource of only 85 koz, CAV trades at (P/NAV) 0.33x at our reference gold price of US$2,000/oz - in-line with our our gold developer group median 0.32x and well below mean 0.55x (also at reference gold price $2,000/oz).

1 Aug 2025

1 Aug 2025

16 July 2025 - Gold explorer WIA Gold (ASX:WIA) announced a resource update for its flagship Kokoseb gold project in Namibia, which grew contained gold ounces by 38% to 2.93 Moz Au @ 1.0 g/t and paves the way for a scoping study that is underway. This decent grade and large size with a strip ratio that also looks decent (appears to be roughly 3 or 4 by visual inspection of cross section) should bode well for economics in the upcoming scoping study, which helps WIA trade at premium to most peers - around the upper-quartile-range of our 91-company gold explorer peer group at a (1 Aug) market cap/oz resource of US$91/oz, as it advances towards graduating to developer peer group with scoping study underway now, and then with a DFS in 2026.

1 Aug 2025

15 July 2025 - Nickel and cobalt developer Canada Nickel Company (TSXV:CNC) announced initial resources at its 80%-owned Mann Central project and 100%-owned Textmont project, both in Ontario. These account for the 5th and 6th deposits uncovered by CNC across its Timmins Nickel District. Mann Central resource contained 1.1Blbs Ni @ 0.22% Ni and 62Mlbs Co @ 0.012% Co (indicated) and 2.5Blbs Ni @ 0.21% Ni and 145Mlbs Co @ 0.012% Co (inferred), which are 80% attributable to CNC, and the estimate also included an exploration target to further double to triple this. Textmont resource contained a higher-grade 240Mlbs Ni @ 0.29% Ni and 9.5Mlbs Co @ 0.011% Co (measured and indicated) and 317Mlbs Ni @ 0.25% Ni and 13Mlbs Co @ 0.011% (inferred). Thes two new deposits grows CNC’s combined attributable resources by ~18% to 44.3 Blbs NiEq (91% from Ni, 9% Co), but CNC stock traded surprisingly flat on 15 July after this news +0% to C$0.86/sh, before finishing the month (ending 1 Aug) down -3.4% (vs. gold developer median decline of -1.4%) to a basic market cap (assuming 213.25m basic shares post completion of recent financings) of C$179m and market cap/lb resource of US$0.003/lb NiEq or $0.007/lb CoEq ($1.37/oz AuEq) for this largest-in-class inventory of nickel resources - a 92% discount to our 15-company nickel developer peer group median US$0.039/lb NiEq ($18.2/oz AuEq) and a 91% discount to our 9-company cobalt developer median $0.070/lb CoEq ($15/oz AuEq). On P/NAV from flagship Crawford 2023 feasibility study at our reference nickel price of US$9.5/lb Ni, CNC trades at (market cap/post-tax NPV) of 0.053x - a 49% discount to nickel developer group median 0.10x.

1 Aug 2025

14 July 2025 - Nickel, cobalt, and gold explorer Nordic Resources Ltd (ASX:NNL) announced a maiden JORC resource estimate for its Hirsikangas project (264 koz Au @ 1.13g/t) that grew its Middle Ostrobothnia/Central Finland gold asset JORC resources by 34% to a reported 1.23 Moz AuEq @ 1.11g/t AuEq (including contained gold of 1.04 Moz Au @ 0.95 g/t Au). The resource update used a cut-off grade of 0.3g/t Au and resulted in 28% more tonnes and 16% more contained gold-equivalent ounces versus a comparable historic 2009 MRE (that used a higher 0.5 g/t cut-off), while only compromising a 10% drop in grade. Including NNL’s vast nickel-cobalt resources in northern Finland, NNL now hosts mineral resources of 5.6 Moz AuEq or 2.7 Blbs NiEq or 1.2 Blbs CoEq (now 19% from Au, 71% from Ni, 7% from Co, rest Cu - at our estimated 3-month trailing average metal prices with no recovery factors). NNL stock traded up +6% on 14 July (vs. ASX gold explorer mean performance of +2.5%) following this news, before closing the month (ending 1 Aug) flat +0% (in-line with 15-company nickel explorer median also flat+0%) at A$0.08/sh, market cap of A$26m, and market cap/oz resource of US$3.02/oz AuEq or $0.006/lb NiEq or $0.014/lb CoEq - a 89% discount to our 92-company gold explorer median market cap $28/oz AuEq, a 43% discount to our 15-company nickel explorer peer group median US$0.011/lb NiEq ($5.3/oz AuEq) and a 52% discount to our 8-company cobalt explorer group median $0.028/lb CoEq ($6.2/oz AuEq). Disclosure: Affiliates of Host Rock Capital hold a position in NNL.

1 Aug 2025

1 Aug 2025

1 Aug 2025

10 July 2025 - Gold explorer Sirios Resources (TSXV:SOI) announced an updated MRE for its 100%-owned Cheechoo gold project in Quebec - 15km from Eleonore gold mine. Total resources grew by +55% to 2.95 Moz Au (including 1.3Moz @ 1.12g/t indicated and 1.7Moz @ 1.23g/t inferred) which had pushed the stock up +17% intraday on 10 July, before it also closed the month (ending 1 Aug) up +17% (vs. gold explorer median gain of +5.6%) to C$0.07/sh, market cap C$27m and market cap/oz resource US$6.6/oz - a 76% discount to 94-company gold explorer group median US$28/oz. This looks surprisingly cheap on market cap/oz, for this relatively large ~3Moz open pit grading over 1g/t with decent strip ratio 2.9:1 within potential trucking distance of a producing mine. Disclosure: Affiliates of Host Rock Capital hold a position in SOI.

1 Aug 2025

10 July 2025 - PGM developer Southern Palladium Limited (ASX:SPD) announced optimized PFS for its 70%-owned Bengwenyama PGM project in South Africa, with improved fundability compared to 2024 PFS by staging development. This is a stock investors ought to hold for its rare high share of primary PGM metal value (significant PGMs are produced as byproducts including from nickel mines), which will allow this project’s construction decision to be tied to rising PGM metal prices (pending final project engineering and permitting). Post tax NPV8% was US$857m at basket PGM price of US$1,557/oz PGM (Pd, Pt, Rh) from initial capex $219m. This massive project with a 54 Moz PdEq (16 Moz AuEq) resource (at 3-month trailing average pricing) has a rare/high 75% share of its metal value coming from PGMs - which looks to be on the higher side of typical for South African’s producing Cu-Ni-PGM+Au mines operated by Sibanye-Stillwater (JSE:SSW), Impala Platinum Implats (JSE:IMP), and Valterra Platinum (JSE:VAL) - one of which ought to acquire this SPD at some point, particularly for its outstanding 27% resource share (for 2.7Moz Rh) coming from the scarcest and most highly valued (and volatile) of precious metals, rhodium (which could really drive the economics and stock value if this metal’s price takes off). Our quoted SPD resource 54 Moz PdEq (16 Moz AuEq) resource is estimated from SPD’s reported resources, translated using our 3-month trailing average pricing of US$990/oz Pd, $1,072/oz Pt, $4.75/lb Cu, $7.03/lb Ni, $3,270/oz Au, $5,439/oz Rh, and $4,171/oz Ir (without recovery factors), which traded on 1 Aug at a (somewhat surprisingly low) SPD market cap/oz PdEq of US$0.86/oz ($2.7/oz AuEq), for a (somewhat surprisingly) wide 82% discount to our (Toronto-dominated) 9-company PGM developer peer group median of $4.9/oz PdEq ($15/oz AuEq). While the economic study metal price sensitivity is not as reliable for the these polymetallic PGM deposits (largely because platinum and palladium prices are sometimes counter-cyclical), SPD trades (on 1 Aug) at P/NAV (market cap/70% attributable post-tax NPV) of 0.036x at our reference palladium price of US$1,800/oz, resulting in a similarly wide 62% discount to our PGM developer median of 0.09x (at same reference $1,800/oz Pd).

Source: Southern Palladium

1 Aug 2025

1 Aug 2025

7 July 2025 - Former PGM explorer - now PGM developer - Bravo Mining Corp. (TSXV:BRVO) announced PEA results for its flagship Luanga project in Brazil - another top tier primary PGM junior mining company with a rare 80% of its metal value contribution coming from PGM’s (11% Rh, 40% Pd, and 29% Pt), according to the PEA release. As such, investors like to hold this stock for its high torque on these 3 PGMs and precious metals - especially Rhodium due to this metal’s extreme volatility and BRVO’s relatively abundant Rh resource of 0.65 Moz Rh, making up 11% of project’s metal value. At our estimated 3-month trailing average metal prices, BRVO holds resource of 21 Moz PdEq (6.9 Moz AuEq), and trades at a (1 Aug) market cap/oz resource of US$11/oz PdEq ($35/oz AuEq) - which had for the past year been at the very top of our 9-company PGM explorer peer group (now 8 companies), and now (1 Aug) trades around the upper quartile range of our 9-company PGM developer peer group - just above the mean $7.4/oz PdEq ($23/oz AuEq). The PEA returned a base case post-tax NPV8% of US$1.25b (at metal prices of $1,271/oz Pd, $1,500/oz Pt, $6,000/oz Rh, $3,251/oz Au, and $8/lb Ni - none of which are far from spot currently), from initial capex of only $496m.

Source: Bravo Mining

9 July 2025 - Former gold explorer - now gold developer - Radisson Mining Resources Gold (TSXV:RDS) announced PEA results for its 100%-owned past-producing O’Brien mine in Quebec, which is one of the highest grade undeveloped gold deposits in Canada. From low initial capex of C$175m and at a gold price of US$2,550/oz Au, a post-tax NPV5% of C$532m was yielded in the study, with an outstanding (after-tax) IRR of 48% and low AISC of US$1,059/oz. The PEA also included an optimized resource estimate at a slightly higher cutoff grade (of 2.2 g/t Au) which yielded +58% more contained gold ounces. Resource grew to 1.51 Moz (including 0.6Moz indicated grading 8.2g/t Au). RDS stock traded up +12% intraday (9 July, vs. developer median flat +0%), before closing the month (ending 1 Aug) up +24% (vs. group mean +3.9%) which also followed a solid deep drill intercept, to a share price of C$0.46, market cap C$177m, and market cap/oz resource of US$85/oz (reduced from larger resource). Previously (on 8 July) RDS had traded above the upper quartile range of 91-company gold explorer peer group on market cap/oz, but now trades just below our gold developer group’s upper-quartile-range, and just above its mean $67/oz. On P/NAV, high-grade RDS trades closer to the middle of the gold developer pack, with a P/NAV (market cap/post-tax NPV) of 0.20x at recent spot gold of $3,318/oz (just above mean 0.16x).

1 Aug 2025

1 Aug 2025

9 July 2025 - Gold explorer Emperor Metals (CSE:AUOZ) announced a maiden resource estimate for its flagship 100%-owned Duquesne West project in Quebec, that doubled the contained gold of the project’s prior historic resource of 0.73 Moz Au (which had graded 5.4g/t) to a current 1.46 Moz grading 1.69g/t. Overall resources including small resource at second project Lac Pelletier grew by 76% to 1.69 Moz. AUOZ stock rose +17% week ending 11 July (vs. gold explorer peer group median flat+0%), before closing month (ending 1 Aug) up +31.6% (vs. group median +5.6%) to share price C$0.25, market cap C$34m and market cap /oz resource of US$14.7/oz - a 53% discount to our 91-company gold explorer median $28.0/oz. AUOZ stock had dipped -9% intraday (9 July, vs. gold explorer median flat +0%) following this news, likely due to the drop in grade vs. apparent historic resource grade, but this should be overshadowed by the size increase, and should not pose much challenges or be much of a hinderance to future economics given the current/recent gold price environment and given most of this maiden resource is pit-constrained and grading over 1 g/t which is typical for open pit mines and thus can be expected to be relatively cheaply-extractible (pending future possible economic studies along with more potential resource growth).

1 Aug 2025

8 July 2025 - Gold developer West Red Lake Gold Mines Ltd. (TSXV:WRLG) announced PEA results for its smaller-sized Rowan project in Ontario, which supplements a prior 2025 PFS for its flagship Madsen project 30 km away. The PEA reported post-tax NPV of C$125m (at US$2,500/oz Au) from initial capital of C$70m. Together with NPV from Madsen PFS at our estimated 3-month trailing average gold price of US$3,270/oz, and according to the NPV sensitivity to gold price provided in each study, our Peer Table estimates a combined NPV (or NAV) of US$729m, and WRLG trades at a (1 Aug) P/NAV (market cap/NPV) of 0.27x - around upper quartile range of our 69-company gold developer peer groups (above the median and mean of 0.11x and 0.16x). And we remind investors that Madsen is an already-built, fully-permitted, and past-producing mine that had operated for a short 18 month period (Pure Gold mine) back in 2021/2022 (when gold price was around $1,800/oz) before it went broke and shut down. And WRLG has recently re-started the mine (announced 22 May), before the ramp-up was paused due to an unfortunate fatality (announced 16 June) that justifiably required a comprehensive investigation and review, before the mine was reported to resume its ramp up some days later. If commercial production can be profitably achieved (which it should based on gold price now being ~$3,300/oz vs. ~$1,800/oz when mine shut in 2022) and WRLG graduates to become an intermediate gold producer, then this P/NAV of 0.29x (at spot price) should re-rate to around the ~0.6-1x range (at spot) that we might typically expect from an intermediate gold producer.

1 Aug 2025

1 Aug 2025

7 July 2025 - Former gold explorer - now gold developer - Dakota Gold Corp. (NYSE:DC) announced results of its Initial Assessment with Cash Flow (IACF) for its Richmond Hill Oxide Head Leach Gold Project in South Dakota (IACF is USA version of a PEA), which forecasted a post-tax NPV5% of US$2.1b (for the M&I&I plan) at gold price of $2,350/oz from initial capital cost of $383m. The lox capex is attributable to the the plans for heap leach processing - which sometimes has its challenges - but apparently not in this neck of the woods where Coeur Mining operates the Wharf mining next door, which generated roughly $95m in free cash flow in 2024 from production of around 98,000 oz. DC and its huge resource of 10.6 Moz AuEq (91% from Au by metal value, rest Ag) trade at a (1 Aug) market cap of US$405m, market cap/oz resource of $38/oz AuEq (in-line with our 72-company gold developer group median $38/oz AuEq, and below mean $67/oz), but a P/NAV of only 0.17x - a 47% discount to group median 0.32x (both at our Reference gold price of $2,000/oz).

8 Jul 2025 - Gold explorer Banyan Gold Corp (TSXV:BYN) announced an updated mineral resource estimate (MRE) for its flagship 75%-owned AurMac project in Yukon (with right to earn up to 100%). The MRE incorporated an additional 21,000m of drilling completed in 2024, and grew overall project resources by 10% to 7.7 Moz Au (100% basis), and for the first time included an indicated resource accounting for roughly one-third of this. Company attributable resources grow by roughly 9.5% to ~6.3 Moz Au. BYN stock traded up +46% this past month ending 1 Aug, to a market cap/oz resource of US$15/oz - a 46% discount to our 91-company gold explorer peer group median US$28/oz.

1 Aug 2025

Disclaimer: Provided for informational and educational purposes on an “as-is” basis, and is not intended as investment advice. For full disclosures, visit www.hostrockcapital.com/disclosures.