- Monthly Metals Mining Rundown - Free

- Posts

- Monthly Metals Mining Rundown for Month Ending 28 Nov 2025

Monthly Metals Mining Rundown for Month Ending 28 Nov 2025

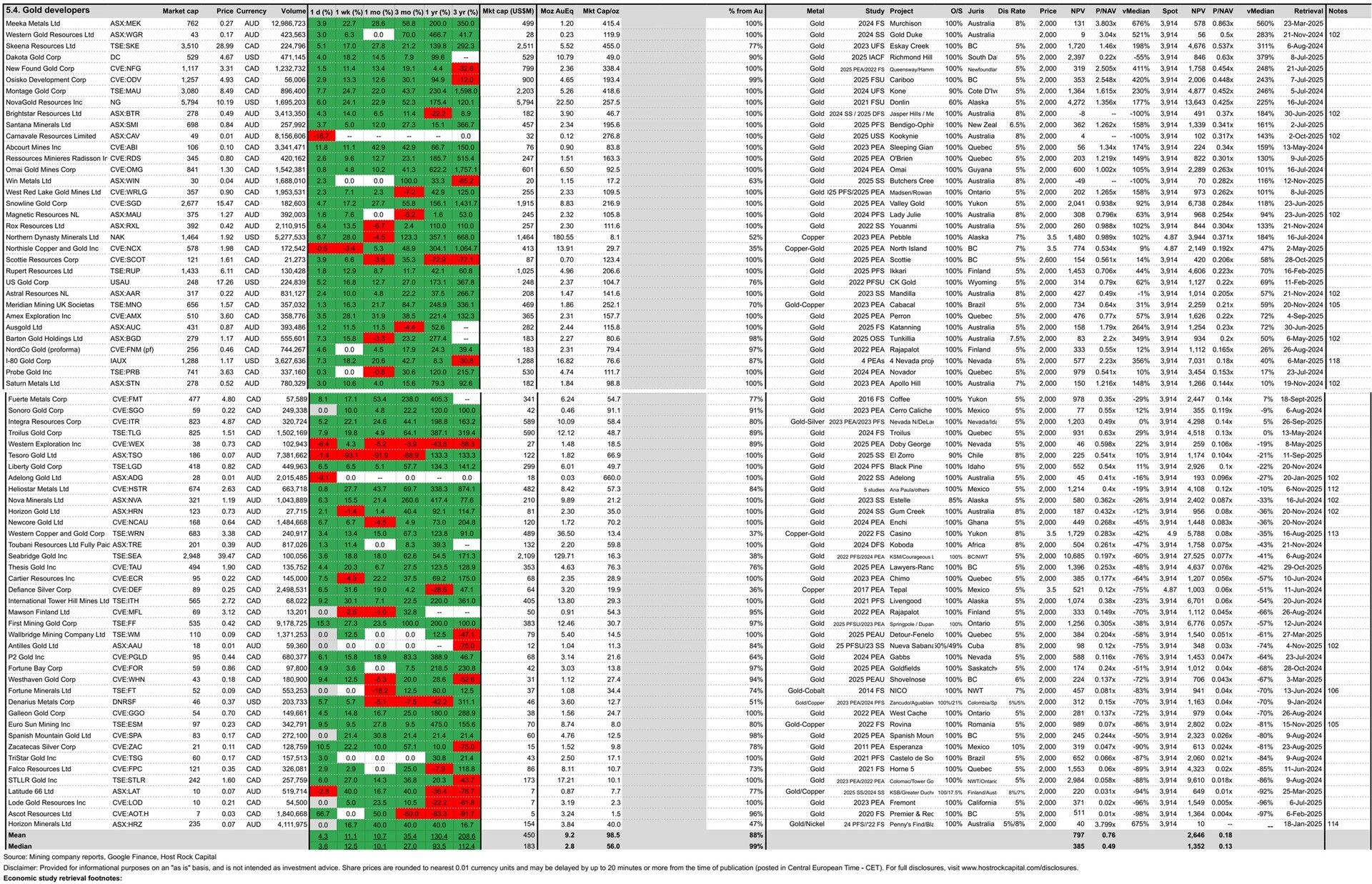

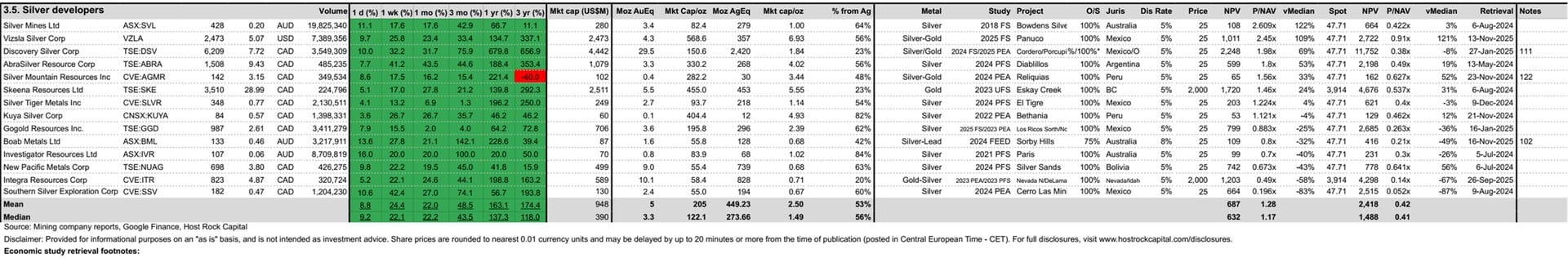

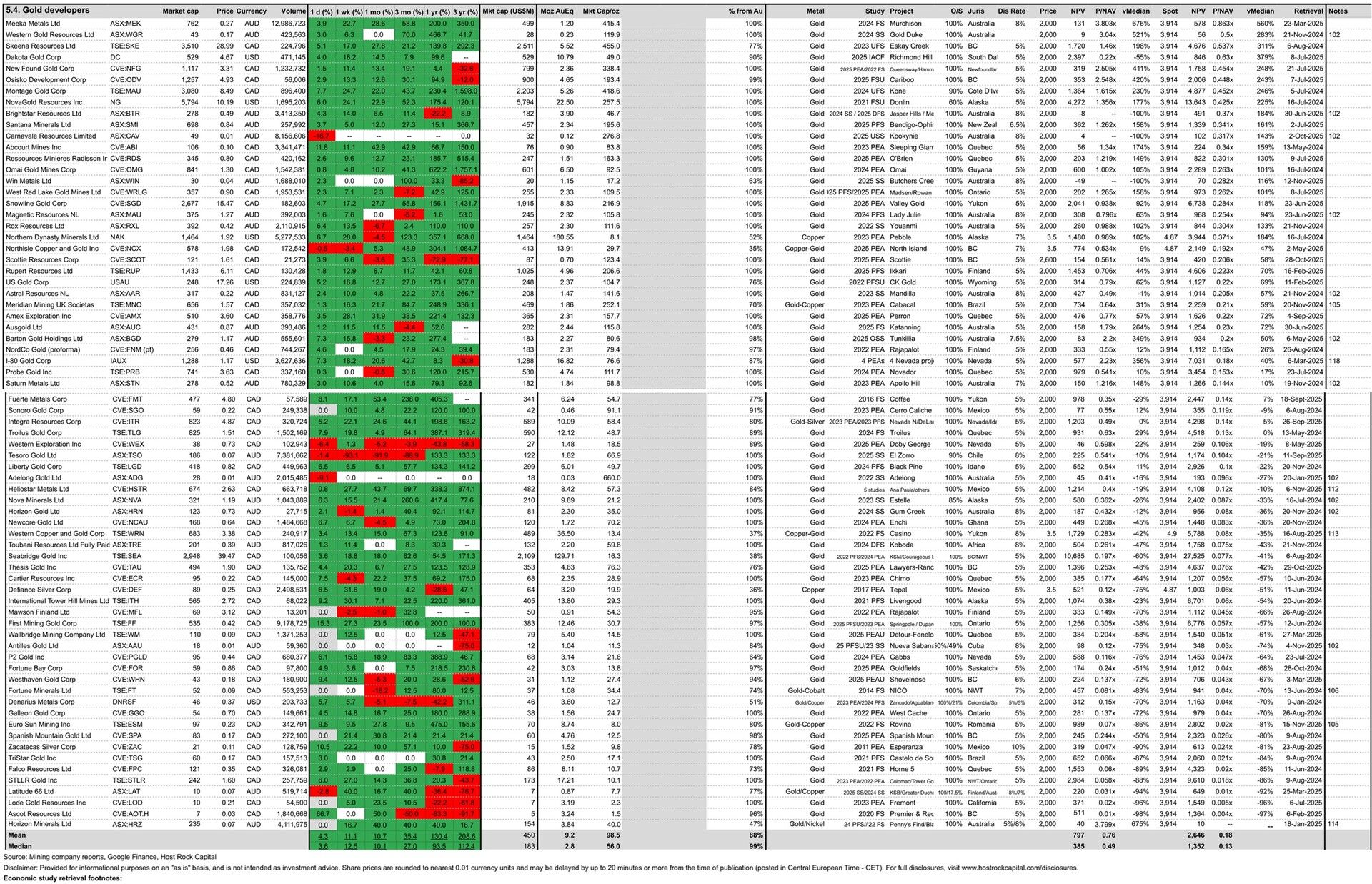

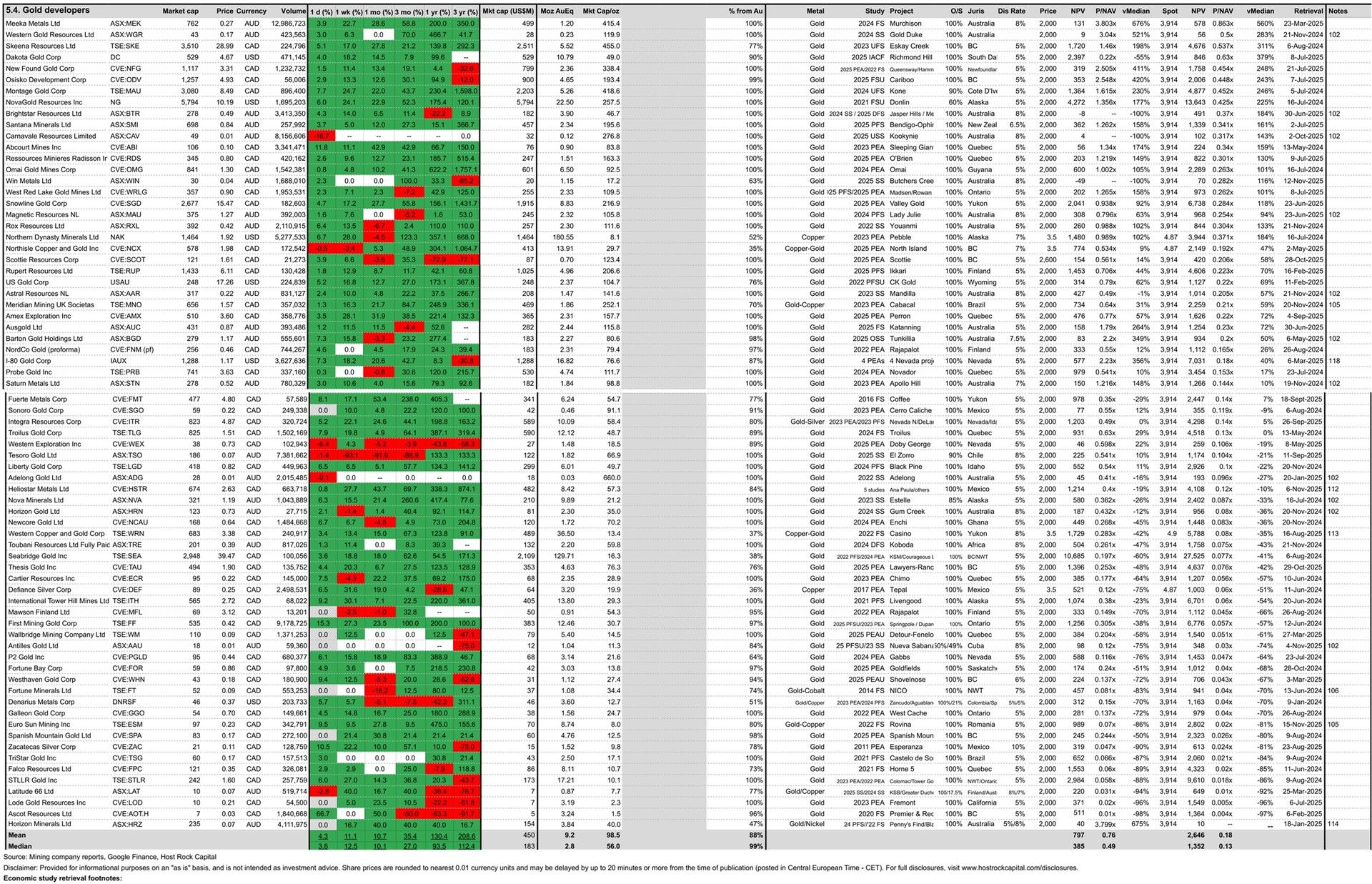

Lithium, Silver, Rhodium, and prices gained by double digits this past month, while platinum, gold, and palladium also inched higher; Most silver stocks gained by more than 20% while most gold stocks rose by more than 10%.

This past month’s metal price and top & bottom mining company peer group movers include:

28 Nov 2025

28 Nov 2025

This past month’s top & bottom 40 performing metals mining stocks (out of Peer Table’s 500) include (share price rounding errors apply, as sourced from Google Finance):

Coverage of metals mining announcements incorporated into this month’s Peer Table (resource updates, economic studies, changes in attributable project ownership) include:

24 Nov 2025 - Copper explorer Copper Giant (TSXV:CGNT) announced an updated mineral resource estimate for its 100%-owned Mocoa copper-molybdenum project in Colombia, which incorporates 9.5km of drilling since the 2022 MRE, enhanced geological interpretation, updated metallurgical data, and revised long-term copper and moly price assumptions. And two rigs continue to turn as part of ongoing 14km drill program at Mocoa. The inferred estimate grew tonnage by ~76% to 1.12Bt @ 0.31% Cu and 0.039% Mo for 7.6Blbs Cu (12.7 Blbs CuEq). And this copper-equivalent rises to ~14.4Blbs CuEq at our 3-month trailing average metal prices of US$4.78/lb Cu and $32.31/lb Mo with no recovery factors, which trade at CGNT market cap/lb of US$0.002/lb ($1.84/oz AuEq) - STILL a HUGE 93% discount to our 40-company copper explorer median US$0.031/lb CuEq ($25/oz AuEq). And this is AFTER the stock SURGED +36% on 24 Nov following this news, before closing the month ending (28 Nov) up +24% (vs. peer median flat +0%) to 31c/sh and market cap C$45m.

24 Nov 2025 - Gold explorer Sunstone Metals Limited (ASX:STM) announced an updated resource estimate that “jumped” 33% to a reported 3.6 Moz AuEq, underlining a world-class scale gold-copper open pit deposit in the emerging/attractive jurisdiction of Ecuador. The estimate is pit-constrained across 3 pockets of porphyry-style mineralization (Brama, Alba, and Melonal), and amounts to 220Mt (18% indicated) @ 0.33 g/t Au, 0.10% Cu, and 1.2% Ag (0.50 g/t AuEq) with a low strip ratio - and more growth is expected with an exploration target for an additional 345-549Mt @ 0.43-0.73g/t AuEq for additional 5-13Moz AuEq (8.6-16.5Moz cumulatively) - which is HUGE. STM stock traded flat +0% on 24 Nov following this news on strong volume (~5x avg) in-line with gold explorer group’s +0%, before closing the month ending 28 Nov up flat +0% to ~2c/sh, market cap A$176m, market cap/oz resource US$38/oz - a 19% discount to group median $47/oz AuEq.

Gold explorer Independence Gold Corp (TSXV:IGO) today (20 Nov) announced a significant update to its mineral resource estimate for its flagship 3Ts project in BC. The update grew open pit and underground gold equivalent resources by roughly 10% to 0.765 Moz (78% from Au, 22% from Ag - at 3-month trailing average metal pricing), and for the first time includes an indicated category - paving the way for a future reserve. IGO stock traded flat +0% on 20 Nov (intraday) following this news to 10c/sh, before closing the month ending 28 Nov DOWN -21% (vs. peer group median monthly gain of +0%), to 11c/sh, market cap C$24m, and market cap/oz resource US$22/oz AuEq - a steep 53% discount to 92-company gold explorer group median $47/oz AuEq.

Intermediate gold producer Aris Mining (TSX:ARIS) today (20 Nov) announced it has entered into a binding term sheet to acquire the remaining 49% interest in the Soto Norte development project in Colombia, where it has ongoing gold production from its Segovia mine. The deal grows ARIS’ M&I resources by +3.4Moz consideration of US$80m ($60m cash, $20m shares at US$11.50/sh) which translates to US$23.5/oz M&I - a fair price for both parties, and most importantly this deal positions ARIS for growth and to become a 1,000,000 oz pa producer from full ownership of producing Segovia, and pipeline projects Marmato, Toroparu, and now also Soto Norte. Somewhat surprisingly, ARIS traded down -3.7% on 20 Nov (intraday) following this news, underperforming our intermediate gold producer median -2.4% (intraday), before closing the month (ending 28 Nov) up +42% (vs. group median +13%) to share price C$19.73, (proforma) market cap C$4.1b, and proforma market cap/oz resource of US$89/oz Au (based on ARIS’ M&I&I resources which grew by 22% on this deal to 32.6Moz) - a steep 66% discount to our 58-company gold producer median US$260/oz AuEq.

Gold developer First Mining Gold Corp. (TSX:FF) today (18 Nov) announced updated PFS results for its Springpole project in Ontario, which included updates to infrastructure stemming from the ongoing provincial and federal EA processes, for which talks with indigenous are ongoing. So while capex was somewhat higher higher compared to 2021 PFS, the design is tighter and more closely resembled what will be permitted and built, and AISC remained low at $938/oz over LOM. Reported After-tax NPV5% was US$2.1b at US$3,100/oz from initial capital US$1.1b. FF’s combined NPV (together with 2023 PEA for Duparquet project in Quebec) fell by ~19% on this announcement to ~US$5.5b at our 3-month trailing average gold price US$3,467/oz. FF stock traded down -5.5% today (18 Nov) following this news (vs. gold developer mean down -0.7%) to C$0.35/sh, market cap C$452m, and P/NAV (from both projects) of 0.059x - a 58% discount to gold developer group median 0.14x.

Copper, nickel, and PGM producer Magna Mining Inc. (TSXV:NICU) today (18 Nov) announced an initial mineral resource estimate for its high-grade Cu-Ni-PGM Levack past-producing mine project located near Glencore’s (LON:GLEN) Strathcona mill outside of Sudbury, Ontario, which totaled 6.1Mt M&I @ 3.5% CuEq including 1.1% Cu, 1.4% Ni, 0.6 g/t Pt, 0.7g/t Pd, 0.1g/t Au, 2.0 g/t Ag and 5.2 Mt Inferred @ 3.6 % CuEq including 1.2% Cu, 1.4% Ni, 0.6 g/t Pt, 0.8g/t Pd, 0.2 g/t Au, 2.1 g/t Ag. The estimate will form the basis for a PEA and recommissioning decision as early as Q1/26. Together with mineral resources from the company’s producing McCreedy West mine, and its PEA-stage Crean Hill, FS-stage Shakespeare, and resource-stage Podolsky projects (all also near Sudbury), this announcement grows Magna’s overall resources by 20% to 4.4 Blbs CuEq or 3.0Blbs NiEq or 19Moz PdEq (6.0Moz AuEq), 41% from Ni, 28% from Cu, 10% from Pt, 9% from Pd. Magna stock rose +10% on 18 Nov following this news, before closing the month (ending 28 Nov) up +0.7% (vs. group median +3.1%) to C$2.71/sh, market cap C$677m, and market cap/lb resource US$0.11/CuEq ($87/oz AuEq) - a 32% discount to our 34-company copper producer group median $0.16/lb CuEq ($126/lb AuEq).

Copper and gold explorer FireFly Metals (ASX,TSX:FFM) today (18 Nov) announced a substantial mineral resource upgrade with strong growth in tonnes, grade, AND contained metal at its Green Bay copper-gold project in Newfoundland. The HIGH-GRADE resource now stands at 50.4Mt @ 2.0% CuEq containing 1Mt CuEq in higher confidnece M&I category plus 29.3Mt @ 2.5% CuEq containing 0.72Mt CuEq inferred, representing a 35% increase in tonnes and a 51% increase in contained CuEq from the prior Oct 2024 update. And the release points our a higher-grade core VMS zone of 8.8Mt @ 3.9% CuEq M&I plus 10.9Mt @ 3.8% CuEq. Together including its 2.8Moz high-grade gold Pickle Crow project in Ontario, this Green Bay MRE increased overall company resources by 50% to 8.4 Moz AuEq (6.1 Blbs CuEq), which are 52% Cu and 47% Au (rest Ag) by metal value at our 3-month trailing average metal pricing. FFM stock traded down on 18 Nov (ASX intraday) -4.6% (in-line with many Cu and Au explorer ASX peers), before closing the month (ending 28 Nov) down -1.6% (vs. group median +0%) to A$1.87/sh, A$1.3b, and market cap/lb of US$0.13/lb CuEq ($105/oz AuEq) - around the 75-percentile range of our gold explorer peer group for this advanced near-development stage explorer with multiple high-grade projects in Canada.

Silver developer Vizsla Silver (TSX:VZLA,NYSE:VZLA) yesterday (12 Nov) announced feasibility study results for its flagship 100%-owned Panuco silver-gold project located in Mexico. Reported HIGH-GRADE maiden reserve was 12.8Mt @ 249 g/t Ag and 2.01 g/t Au (for a reported 416 g/t AgEq) containing 103 Moz Ag and 0.83Moz Au. According to NPV sensitivity provided in the study, post-tax NPV5% at our 3-month trailing average silver price of US$39.6/oz Ag was US$2.1b (which is a 50% increase from prior 2024 PEA results at this metal price!). VZLA stock traded up +12% on 12 Nov following this news, before closing the month (ending 28 Nov) up +23% (in-line with group median +22%) to US$5.07/sh, market cap US$2.5b, and P/NAV 0.9x for this advanced feasibility-stage, best in-class PRIMARY SILVER developer (resource is ~ 55% Ag / 45% Au by metal value) at our 3-month trailing average price US$47.7/oz.

Nickel explorer and former gold explorer – now gold developer – WIN Metals (ASX:WIN) yesterday (12 Nov) announced scoping study results for its Butcher Creek project in West Australia. Study contemplates open pit and underground mining, 600 ktpa CIL plant and associated infrastructure, with 9 year LOM, processing 3.29 Mt @ 2g/t Au for 200koz recovered. Pre-tax NPV8 was A$143m from pre-production capital of A$142m. Including both nickel and gold assets, WIN hosts mineral resources of 1.25 Moz AuEq (629 Mlbs NiEq) which are 66% from Ni, 31% from Au, rest Li (across 3 deposits). WIN stock trades at ~4c/sh, market cap A$30m, and market cap/oz resource US$17/oz AuEq ($0.03/lb NiEq) – a 79% discount to gold developer group median US$58/oz (and in between Ni explorer group median $0.023/lb and mean $0.077/lb NiEq). On P/NAV taken as market cap/70% of pre-tax NPV, WIN trades at 0.28x – around the 80-percentile of our gold developer group (with median 0.13x and mean 0.18x) at our 3-month trailing average gold price $3,914/oz.

Copper developer Solaris Resources Inc. (TSX:SLS) today (6 Nov) announced a PFS and maiden reserve for its large Warintza project including a substantial increase to mineral resources, which grew to 42 Blbs CuEq (58 Moz AuEq) including 27 Blbs Cu and very low grade Au, Mo, and Ag (65% Cu by metal value at our 3-month trailing average metal pricing), including M&I 3.7 Bt @ 0.24% Cu, 0.01% Mo, 0.04 g/t Au, 1.2 g/t Ag for a reported 0.32% CuEq. Reported post-tax NPV8 was US$4.6b at $4.50/lb Cu from initial capex of $3.7b. SLS and this now fairly advanced stage large copper project traded up +4.7% on 6 Nov on this news, before closing the month (ending 28Nov) up + to C$9.4/sh, market cap C$1.56b, P/NAV (market cap/post-tax NPV) of 0.42x - in between (near the middle of) our 34-company copper developer peer group median 0.23x and mean 0.62x at same Cu price).

Gold developer Horizon Gold Ltd (ASX:HRN) yesterday (4 Nov) announced an updated resource for its flagship Gum Creek gold project in West Australia, which grew ounces by 8% to 2.3Moz and grade by 26% to 1.89 g/t. HRN stock rose +1.4% on 4 Nov after this news (vs. gold developer median loss -0.6% for the day), before closing month (ending 28Nov) up +1.4% (vs. group median +10%) to 73c/sh, market cap A$123m, market cap/oz resource US$35/oz Au (vs. developer median $58/oz AuEq), P/NAV of 0.08x (36% discount to group median 0.13x).

Gold developer Denarius Metals (OTC:DNRSF) today (3 Nov) announced an updated resource for its 100%-owned Zancudo project in Colombia, following 7,225m of drilling completed in the Company’s 2024 drill campaign. The deposit strikes for 2,500m with known vertical extent of 400m, and remains open for further expansion in all directions. The update used a slightly lower cutoff grade of 3.25 g/t AuEq (compared to 4g/t AuEq in 2023), which together with new drilling helped grow overall resource tonnage by 37% to 5.6 Mt, including 0.98Mt indicated grading 6.9 g/t Au, 84 g/t Ag (7.9 g/t AuEq). Overall contained metal grew 16% to a reported 1.2Moz AuEq (indicated + inferred). Including the companies other polymetallic projects in Spain, company resource grow by 6% to 3.68 Moz AuEq (50% from Au, 22% from Zn, 12% from Ag, rest Cu-Ni-Pb-Co-Pd-Pt). From combined 2023 PEA for this Zancudo project and 2024 PFS for other Aguablanca project in Spain, Denarius stock trades at P/NAV of 0.15x at our Reference gold price US$2,000/oz Au - a 70% discount to gold developer median 0.49x. On market cap/oz, Denarius trades at US$12.7/oz AuEq, for a 78% discount to gold developer median $58/oz AuEq.

Silver producer and intermediate gold producer Coeur Mining, Inc. (NYSE:CDE) today (3 Nov) announced the acquisition of intermediate gold producer New Gold Inc. (NYSE:NGD) in an all-stock US$7b deal, which includes a 16% premium to NGD’s last price. NGD shareholders are to receive 0.4959 shares CDE per NGD share and will own 28% of combined company (CDE 62%). CDE gets NGD’s mineral resources of ~8.6Moz AuEq (including 2 producing mines in Canada), which are 70% from Au, 27% from Cu, and 3% from Ag (with no recovery factors at our 3-month trailing average metal pricing) for a price of US$785/oz AuEq, which initially sounds pricey relative to intermediate gold producer median $224/oz AuEq and even to CDE’s prior (31 Oct) market cap/oz of US$638/oz. Stemming in part from these initial optics, CDE stock sold off by -12% on 3 Nov (after this news), before closing the month (ending 28Nov) up +0.6% (vs. group median monthly gain +13%) to ~US$17/sh and pro forma market cap ~US$18b. But based on simple equating of NAV multiples, we ultimately exepct CDE stock to gain by as much as ~50% on this deal. Here’s why: We’d expect an intermediate gold producer to trade at NAV multiple (P/NAV or price-to-net-asset-value) around ~1x, whereas we’d expect a SILVER dominant precious metals producer or SENIOR GOLD producer to receive a NAV premium of up to +1x, for a 2x NAV multiple overall. CDE looks like had already warranted this ~2x NAV multiple from its high 38% of resources (and similarly high share of production) coming from silver (based on CDE’s market cap/oz AuEq resource being more than double intermediate gold producer group median). BUT there is a special sweet spot implied here, IF a company can achieve BOTH: (1) Silver dominance, AND (2) Senior gold producer status, this company should warrant multples as high as ~3x! This type of multiple has recently only been reserved for the likes of Wheaton Precious Metals (NYSE:WMP) with its 50% of resource metal value (and high share of production) coming from silver, which helps WPM trade at the very top of the senior gold producer pack on market cap/oz resource. That’s what this deal is about for CDE, which now graduates to our SENIOR GOLD PRODUCER peer group (and also remains a SILVER PRODUCER with it’s (still) relatively high 26% of metal value coming from silver - second only to WPM in senior gold group), and so CDE’s warranted NAV multiple could increase by as much as 50% from ~2x to ~3x. A 50% rise from CDE’s (3 Nov) proforma market cap/oz AuEq of ~US$609/oz AuEq (at ~US$15.14/sh) would yield ~US$911/oz (not even HALF of WPM’s existing ~US$1,866/oz AuEq). The good folks on Bay Street SHOULD have picked this up (altough they tend to be overly-obsessed with cash flow multiples, so might have missed it 😉). NAV incorporates cash flow, but also reserves/resources replacement, and is better for rules of thumb and comparisons between peer groups (AND is more proportionate to market cap/oz resource, which is handy vis a vis our Peer Table).

Disclaimer: Provided for informational and educational purposes on an “as-is” basis, and is not intended as investment advice. For full disclosures, visit www.hostrockcapital.com/disclosures.