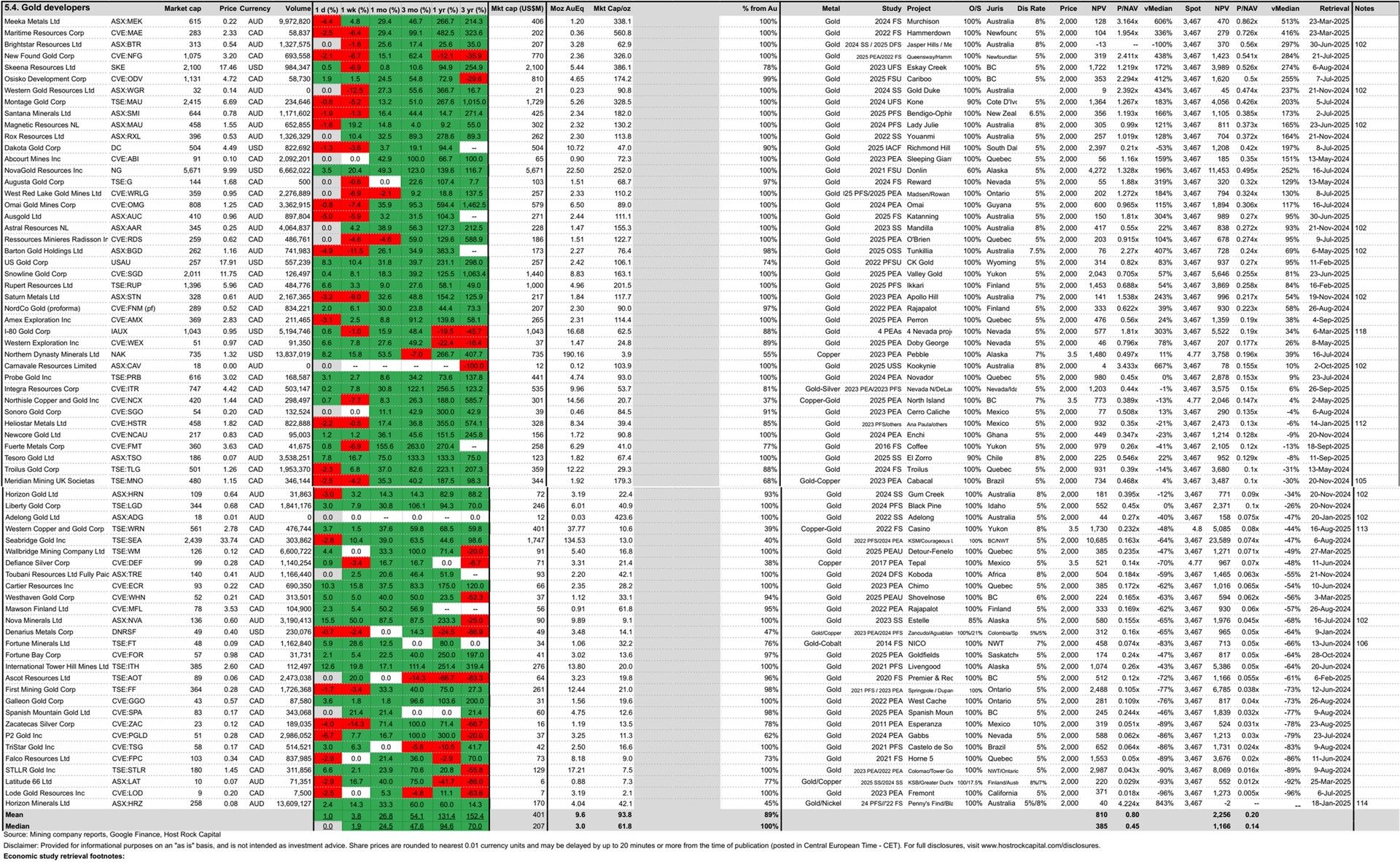

- Monthly Metals Mining Rundown - Free

- Posts

- Monthly Metals Mining Rundown for Month Ending 3 Oct 2025

Monthly Metals Mining Rundown for Month Ending 3 Oct 2025

Most metals mining stocks rose more than 20% during September, for the BEST MONTH in a long time; Silver, platinum, copper, and gold metal prices stood out, led by silver which rose 17% and hit $48/oz.

This past month’s metal price and top & bottom mining company peer group movers include:

3 Oct 2025

3 Oct 2025

This past month’s top & bottom 40 performing metals mining stocks (out of Peer Table’s 491) include (share price rounding errors apply, as sourced from Google Finance):

Coverage of metals mining announcements incorporated into this month’s Peer Table (resource updates, economic studies, changes in attributable project ownership) include:

2 Oct 2025 - Gold developer Carnavale Resources Ltd (ASX:CAV) today announced an updated scoping study for its Kookynie gold project in Australia, which replaces last year’s study. Pre-tax NPV8 was A$188m from pre-production capital of only A$3m. At our 3-month trailing average gold price US$3,350/oz, the NPV dropped ~8% and stock now trades at P/NAV (market cap/70% of pre-tax NPV) of 0.155x - in between our 69-company gold developer peer group median and mean 0.14x and 0.20x.

3 Oct 2025

26 Sept 2025 - Gold explorer - and now also nickel explorer - Renforth Resources Inc. (CSE:RFR) announced a maiden resource for its Victoria nickel-polymetallic project in Quebec based on 10,000m of drilling over 2.5km strike length within a 20km long structure. Resource includes two starter pits spanning 2.5km, pit-constrained with a relatively shallow depth of 200m and low waste:ore strip ratio of 1:1, and is reported to remain open along strike and towards depth. Initial size was 125Mt @ 0.12% Ni, 0.02% Cu, 0.01% Co, 0.08% Zn, and 0.38 g/t Ag for a reported 0.15% NiEq containing 413 Mlbs NiEq. But at our 3-month trailing average metal pricing, this nickel-equivalent grade comes in higher at 0.17% NiEq containing 469 Mlbs NiEq. This grade is quite low - especially for the byproduct (non-nickel) metals, but this should be largely offset in a future planned PEA (after another resource update, according to the release) by a very low waste-to-ore strip ratio of 1-to-1, AND by the fact that inital ore sorting test work announced by RFR completed using TOMRA equipment encouragingly suggested that this nickel-polymetalic mineralization could be concentrated (same TOMRA manufacturer equipment that was successfully applied at a production-scale on a bulk sample by Osisko Development in BC). Together with RFR’s 0.36Moz Au gold deposit, RFR hosts combined resources of 741 Mlbs NiEq (1.3Moz AuEq), which are now 51% from Ni and 27% from Au. RFR stock traded up +50% this past week ending 3 Oct (vs. group median flat +0%) to 3c/sh, C$9m market cap, and market cap/lb of US$0.009/lb NiEq ($4.7/oz AuEq) - a 56% discount to Ni explorer median $0.021/lb NiEq ($10.6/oz AuEq), and a 90% discount to gold explorer peer group median $48/oz AuEq.

3 Oct 2025

3 Oct 2025

25 Sept 2025 - Chilean lithium brine developer - now also Chilean gold explorer - Wealth Minerals (TSXV:WML) announced a letter of intent (LOI) to acquire 100%-interest in the past-producing Andacollo Oro gold project in Chile with vast historic gold resources of 2.02Moz @ 0.48 g/t (M&I) and 5.06Moz @ 0.45 g/t (Inferred). Past production was 1.12Moz via open pit heap leach from 1998 to 2018 at 20,000 tpd which produced up to 135,000 ozpa, and permits are reported to remain in place (mining rights, land title, and water rights). Purchase price is 12.5m WML shares (post-7-to-1-share-consolidation) or 87.5m shares preconsolidation shares which had closed at 17c/sh on 24 Sept for a value C$14.9m. Although this purchase price excludes deferred payments to be assumed by WML from the Chillean subsidiary, which are set at US$30m over 4 years, up to $7m of which can be made in WML shares. Including these 87.5m of pre-consolidation shares to be issued, and including annother 41.67m shares to be issued in a concurrent non-brokered private placement also included in the announcemnet (at 12c or 29% discount to prior close 17c, with full warrant at 18c for 2 years with right to accelerate exercise period over 36c), but excluding future dilution from deferred aggregate payments of US$30m in cash and shares, WML basic shares will increase by ~35% to 491.53m shares. WML stock gained +15% on 25 Sept, intraday following announcement to 19c/sh where it finished the week ending 26 Sept up +58% (vs. gold expl. median +4.4%), at pro-forma market cap C$93m (excluding future dilution from US$30 deferred payments) or US$6.0/oz AuEq resource (11.2Moz AuEq including 7.1Moz Au and 1.4Mt LCE) - an 86% discount to new 90-company gold explorer peer group median US$43/oz AuEq. And if a cautious investor wanted to be clever and conservatively assume the deferred payment of US$30m or ~C$41.8m is covered with 12c stock (in-line with concurrent C$5m cap raise), basic shares would rise to ~840m sh and market cap/oz would still only be US$10/oz AuEq - still a 77% discount to gold explorer median US$43/oz.

3 Oct 2025

23 Sept 2025 - Copper explorer ATEX Resources (TSXV:ATX) announced a resource update for its flagship Valeriano project in Chile, that grew copper-equivalent ounces by 41% to 33.85 Blbs CuEq (48.1 Moz AuEq) - 67% from Cu, 28% from Au, rest Ag. ATX stock traded down slightly -1.6% on 23 Sept following this news vs. peer group median flat +0%, before closing month ending 3 Oct up +18% (in-line with average monthly performance) to C$2.70/sh, market cap C$816m, and market cap/oz resource of US$0.017/oz CuEq ($12/oz AuEq) - a 34% discount to our 38-company copper explorer peer group median US$0.025/oz CuEq ($18.2/oz AuEq).

3 Oct 2025

23 Sept 2025 - Gold developer (and uranium explorer) Fortune Bay Corp. (TSXV:FOR) announced results of an updated PEA for its flagship Goldfields Gold project in northern Saskatchewan. The study contemplated a lower 5,000 tpd production level (was 7,500tpd in 2022), which helps expedite the path to production by lowering startup capital (to C$301m incl. $51m contingency), and by staying within provincial permitting with valid 2008 EIS and avoiding a federal impact statement. Resources were also updated but remained relatively unchanged at 24Mt grading 1.28 g/t Au for 0.99Moz indicated and 7.4Mt grading 0.90 g/t Au for 0.21Moz Au. PEA contemplated 80% of combined resource for 25.2Mt with a waste-to-ore strip ratio of 3:1 (this strip of 3 combined with grade over 1g/t is quite solid). As a result of the lower throughput, economics took a slight hit - with an after-tax NPV of US$817m at our 3-month trailing average gold price of US$3,467/oz (was $918m with old 7,500 tpd study), which pushed the P/NAV (market cap/NPV) up just slightly to 0.05x (was 0.04x) after the stock rose 9% on 23 Sept before closing the month (ending 3 Oct) up +22.5% (in-line with group median) to 98c/sh - still a wide 64% discount to our 69-company gold developer peer group median 0.14x.

3 Oct 2025

23 Sept 2025 - Silver explorer Unico Silver (ASX:USL) announced a substantial resource update that grew its project resources at 100%-owned Cerro Leon project in Argentina by ~87% to 31Mt @ 62 g/t Ag, 0.55 g/t Au, 0.54% Pb, 1.1% Zn for a reported 162 Moz AgEq @ 161g/t AgEq (30% indicated, rest inferred) following 20.5km of new drilling for low discovery costs of USD 10c/oz AgEq. At our 3-month trailing average metal prices, these silver-equivalent resources translate to 147 Moz AgEq (1.6 Moz AuEq) and are 42% silver by metal value. Some 45Moz AgEq of these resources are reported to be free-milling, open-pittable, 67% of which are in indicated category, providing a solid foundation for a future scoping study. USL stock traded up slightly on 23 Sept following this news, +2.8% (vs. silver explorer median +5%), before closing the month ending 3 Oct up +27.5% to 65c/sh, market cap A$329m or market cap/oz resource of US$1.53/oz AgEq ($134/oz AuEq) - far below the $2.37/oz AgEq ($216/oz AuEq) where USL traded before this update - and just above with 26-company silver explorer peer group mean $1.36/oz AgEq ($119/oz AuEq). And the company has another upcoming MRE for Joaquin, has another 30km of drilling underway, and has clear line-of-sight to reach resources of ~250Moz AgEq.

3 Oct 2025

15 Sept 2025 - Former gold (and Cu, Ag) explorer - now gold developer - Fuerte Metals (TSXV:FMT) announced the acquisition of the Coffee gold project in Yukon from Newmont Corporation (NYSE:NEM) for up to US$150m ($10m cash, $40m stock, and a 3% royalty that can be repurchased for $100m). Project has a new M&I resource of 3Moz @ 1.15 g/t and 0.8Moz inferred @ 1.17 g/t. FMT’s basic shares outstanding will nearly triple to ~99.3m for the $40m share payment to NEM combined with a concurrent $50m private placement of subscription receipts at C$1.65/sh led by Stifel and BMO. FMT stock rose roughly 90% week ending 19 Sept following the announcement, before closing the month ending 3 Oct up +155% (vs. peer median +25%) to C$3.63/sh, and proforma market cap C$360m, which equates to a P/NAV (taken as pf market cap/post-tax NPV) of 0.26x at our reference gold price $2,000/oz (if we dust off the old/outdated 2016 Kaminak Resources Feasibility Study), which is still a 41% discount to our 68-company gold developer peer group median 0.45x (at $2,000/oz).

3 Oct 2025

16 Sept 2025 - Copper developer Arizona Sonoran Copper Company Inc. (TSX:ASCU) announced a resource update for its flagship past-producing Cactus mine project in Arizona, which grew M&I resource by 50% to 11 Blbs Cu and total M&I&I resources by 14% to 12.7 Blbs, 75% of which is leachable with remaining 25% consisting of sulfides, and which paves the way for a maiden reserve and PFS due Q4/25 (following a PEA last year). ASCU stock traded up +14% over past month ending 3 Oct (vs. peer group median gain +19%), to a market cap/NPV (P/NAV) of 0.27x at our reference copper price US$3.50/lb - just above our 34-company copper developer median 0.23x and well below mean 0.66x.

3 Oct 2025

15 Sept 2025 - Gold explorer First Nordic Metals (TSXV:FNM) announced a merger with gold developer Mawson Finland Limited (TSXV:MFL) to create a leading Nordic gold development (and exploration) company. Importantly, leadership will be consolidated under a new incoming chairman and new CEO - both veterans with decades of experience working together. Incoming Chairman Peter Breese has over 35 years experience with a specialty in building and operating mines - including as President and CEO of Asanko Gold (now Galiano Gold TSX:GAU) through financing, construction, and comissioning of the Asanko Gold Mine in Ghana - on time and within budget. And new CEO and incoming director Russell Bradford is a metallurgist and seasoned mining executive with over 35 years of project management and operational experience - including for several tier-1 companies, including Anglo American. And most recently Mr. Bradford served as Managing Director of Aston Minerals which he merged with Torque Metals in 2025. And Darren Morcombe also joins as Special Advisor - mining executive based in Switzerland with over 30 years international experience across mining finance, operations, and corporate leadership. MFL shareholders will receive 7.1534 shares of NordCo (FNM proforma) before a concurrent 4-to-1 consolidation, resulting in a ~23% premium to Friday (12 Sept) closing prices of C$2.68/sh (MFL) and C$0.46/sh (FNM), before (~11.5%) dilution from a C$30m concurrent non-brokered subscription receipt financing. MFL stock was up +2.6% intraday (15 Sept) following this news before closing day down 7% (on 2x avg volume, before rising 13% the next day (16 Sept) on 7x avg volume after our note on LinkedIn here. FNM had traded (on Friday 12 Sept before announcement) at market cap/oz AuEq resource of US$74/oz - which had been around the 65th-percentile of our 90-company gold explorer peer group (between median $39/oz and mean $78/oz). But now FNM (NordCo) add’s development stage Rajapalot project in Finland with a 2023 PEA (to its existing 45%-owned Barsele project in JV with Agnico Eagle within Sweden’s Gold Line Belt, and Kylmakangas project in Finland’s Oijarvi Greenstone Belt - both resource stage) and graduates to our gold developer peer group, and traded on 15 Sept at proforma market cap/oz resource of US$70/oz AuEq (after stock fell -14% intraday) before stock closed the week (ending 19 Sept) flat +0% at C$0.46/sh, proforma market cap C$256m or US$81/oz AuEq, which is only ~60th-percentile of our 73-company gold developer peer group, which also has step change higher median and mean market caps/oz of US$54/oz and $88/oz. And FNM maintains its aggressive exploration plans for 2025-2026 of 15-20,000m/yr across its Sweden’s Gold Line belt, with 3,500m at Barselle JV, while MFL’s side will continue its permitting and engineering as it targets strategic project status according to EU’s CRMA (for Rajapalot’s cobalt byproduct).

3 Oct 2025

11 Sept 2025 - Gold developer Tesoro Gold (ASX:TSO) announced the outcome of a scoping study for its 90%-owned flagship El Zorro open pit project in Chile, which more than doubled total mill throughput to 40.7 Mt @ 1.02 g/t Au (was 17.1 Mt @ 1.25 g/t Au) since the 2023 Phase 1 scoping study. Reported all-in-sustaining-costs were low at $1,216/oz Au. And economics improved sunstantially compared to 2023 study due to the much larger project, to a post-tax NPV7.5 of US$663m at $2,750/oz from initial capital of $248m (includes $41m capitalized pre-strip), which rises substantially to $966m at TSO’s reported spot case of $3,330/oz Au. TSO stock rose +9% on 11 Sept following this news, before closing the week ending 12 Sept +25% (vs. gold developer group median +7.3%) to 5.3c/sh and market cap A$m. At our estimated 3-month trailing average gold price of $3,350/oz, and according to the metal price sensitivity analysis provided in the release, TSO’s NPV rises to $894m (was $619m with old 2023 study) and P/NAV (market cap/NPV) now trades at 0.08x at TSO price of 5.3c/sh - a 36% discount to our 67-company gold developer peer group median 0.12x. And it’s still early days for this project which is still growing fast. Not only is this Ternerra open pit deposit at El Zorro still open within the existing pit shell, underground potential beneath the open pit deposit has also already been identified, and this Ternerra deposit is “the first of multiple deposits capable of contributing to a signficantly larger future operation,” as stated by management in the release.

3 Oct 2025

9 Sept 2025 - Cu-Ni-PGM producer Anglo American (LON:AAL) and Cu-Ni producer Teck Resources Limited (NYSE:TECK) announced a merger of equals to form a global critical minerals powerhouse, with 70% of its production exposure coming from copper (according to press release). Teck shareholders will receive 1.331 shares AAL per share TECK for a ~17% premium to TECK’s prior share price, with (all but 1%) of the premium being repaid to AAL shareholders by AAL in a special $4.5b dividend. Reported pre-tax annual recurring synergies are US$800m plus an additional $1.4b annually beyond 2030. Former Teck had a high 64% of it resource metal value coming from copper (and decent amount of nickel), whereas Anglo also has nickel but had been more diversified into PGMs and gold than Teck. Together this new Anglo Teck create’s a ~US$60b market cap bohemoth with 51% of its resource metal value coming from copper (diversified with PGMs+Au), joining the likes of top copper producers Glencore (LON:GLEN, mtk cap US$48b) and Freeport-McMoRan (NYSE:FCX, mkt cap $63b) - each of which (all 3) have some quarter trillion pounds in the ground of copper resources (BHP has nearly half a trillion pounds in ground copper, but it is more diversified into non-metals than these 3, with iron ore making up its largest revenue share at $28b in 2024). Pure-play copper producer FCX (with 80% of resource metal value coming from copper, rest Ag-Au) has been dominant trading (on 12 Sept) at market cap/lb resource of US$0.22/lb CuEq ($0.28/lb Cu) vs. GLEN’s (12 Sept) $0.10/lb CuEq ($0.18/lb Cu) and new (3 Oct) proforma Anglo Teck’s US$0.11/lb CuEq ($0.23/lb Cu) - a 22.5% discount to 23-company copper producer median $0.142/lb CuEq. Should copper prices dip in near term and knock FCX off it’s dominant pedistal (in terms of market cap/lb CuEq resource), this new Anglo Teck should be well equipped to rise to the top spot (of these 3) with its PGM+Au diversification, provided PGMs+Au continue to outperform. GLEN on other hand is similarly diversified with 54% of its value of metal in ground coming from copper, but with other metals Co-Zn-Pb-Ag…GLEN could instead overtake FCX on market cap/lb if this basket of seconadary metals instead outperforms more than Anglo Teck’s PGMs +Au. Both stocks rose following this announced deal, with AAL closing month ending 3 Oct up +25.4%, and TECK up +28.9% (vs. copper producer median gain of 26.5%).

3 Oct 2025

5 Sept 2025 – Gold developer New Found Gold (TSXV:NFG) announced the acquisition of fellow Newfoundland gold developer Maritime Resources (TSXV:MAE), in an all stock deal where MAE shareholders will receive 0.75 shares NFG per share MAE, for a 32% premium to MAE 20-day VWAP, with NFG and MAE shareholders owning 69% and 31% of combined entity. MAE’s FS-stage Hammerdown project is much smaller than NFG’s PEA-stage Queensway project (resource of 0.36 Moz vs NFG’s resources of 2.36 Moz). But Hammerdown (with FS in 2022) is much more advanced than Queensway, is a near-term producer (production targeted for 2026), is less costly to build (easier to fund) than the much larger and more valuable Queensway project – value that could more easily be unlocked with the cash flows (and P/NAV multiple) from Hammerdown. A similar strategy was employed by Discovery Silver Corp. Silver (TSXV:DSV) in its acquisition of Porcupine mine complex from Newmont Corporation (NYSE:NEM) announced in January (covered in our Weekly Rundown here:

https://lnkd.in/dthsXJKT with 200 impressions), from which cash flows can be used to help develop the company’s former flagship Cordero in Mexico. Since the DSV deal was announced in January (closed in April), DSV’s share price has quadrupled. NFG’s proforma basic shares on closing the MAE acquisition is reported in the release to be 335.93 sh. NFG stock traded down -4.6% on 5 Sept intraday following announcement alongside MAE that was also down -4.3% vs. gold dev peer median gain +2.0% intraday, but both stocks rose the following week, with NFG closing month ending 3 Oct up +15% (below peer peer group median monthly performance of +25%) to C$3.20/sh, proforma market cap C$1b, and P/NAV of 0.54x (for both of NFG’s projects) at our 3-month trailing avg gold price of US$3,467/oz) – a far cry from the P/NAV in the ball park of ~1x that might be expected from a junior gold producer (as NFG is now set to become in 2026, when Hammerdown is due to come online).

3 Oct 2025

4 Sept 2025 - Copper developer Koryx Copper (TSXV:KRY) announced an updated PEA for its 100%-owned flagship Haib project in Namibia, which replaces a prior 2021 PEA. The study contemplated 28 mtpa conventional milling and 7mtpa low grade heap leach (replacing the 20 mtpa bio-heap leach contemplated in 2021). So capex is obviously up signficantly (to US$1.559b), but the more conventional processes in this study should have much lower technical risk. Reported post-tax NPV8 at US$10,000/t Cu ($4.536/lb Cu) was US$1.742m with low all-in-sustaining costs of $2.46/lb Cu. At our estimated 3-month trailing average copper price of US$4.77/lb Cu, this NPV rises to $2.1b - encouragingly and somewhat surprisingly in-line with the 2021 PEA results at this price, despite the large jump in capex (for the mill). KRY stock traded up +2% on 4 Sept after this announcement on strong volume, before closing month 3 Oct up +60% (vs. copper developer mean weekly gain of +19%) to C$1.57/sh, market cap C$153m, and P/NAV (simplified as market cap/post-tax NPV) of 0.051x - a 33% discount to our 35-company copper developer peer group median 0.08x (at 3-month trailing $4.77/lb).

3 Sept 2025 (after-market) - Lithium brine developer Standard Lithium (NYSE:SLI) announced definitive feasibility study (DFS) results for its 55%-owned (through a JV) South West Arkansas project contemplating production of 22.5ktpa lithium carbonate, which replaces a prior 2023 PFS that contemplated production of 30ktpa lithium hydroxide monohydrate. As is often the case for this key derisking step up to DFS stage that has tighter costs estimating (and should be somewhat expected), the project’s economics took a bif of a hit since the 2023 PFS. Encouraingly, all-in operating costs remained low at US$5,924/t Li carbonate, although capex increased slightly by 14% to US$1.45b inlcuding 12.3% contingency (was $1.27b including 20% contingency in PFS), with a reported after-tax NPV8 of US$1.275b (for 55% attributable portion of $701m) at price of US$22,400/t lithium carbonate. At our reference lithium carbonate price of $20,000/t lithium carbonate, this attributable NPV decreases to $476m, resulting in a month ending 3 Oct closing P/NAV (market cap/NPV) of 1.6x (at US$3.07/sh). The prior 2023 PFS results had yielded a 55%-attributable NPV of US$1,166 at our reference lithium hydroxide price of $24,000/t (which we assume to be a 20% premium to our reference lithium carbonate price of $20,000/t for approximate comparison purposes), which had yielded a P/NAV of 0.48x (at prior SLI price of US$4.10/sh). Based on this apparent jump in P/NAV, SLI stock could take a hit in the ball park of up to ~30%, which has not happened but would create a buying opportunity for other investors looking for futher derisking steps towards first production targeted for 2028, for this most advanced and most de-risked Li brine developement project in the US, especially considering the encouraing field-scale Direct Lithium Extraction (DLE) test results incorporated to this DFS (and reported on 11 March), which involved production of 3,672 litres of concentrated and purified lithium chloride solution from a field-scale DLE pilot plant using existing production wells. Stock is up +43% over past month ending 3 Oct vs. peer group median flat +0%.

Standard Lithium DLE field pilot. The larger blue and white enclosure houses the pre-treatment, filtration and DLE (LSS column) process steps (Source: Standard Lithium, 11 March 2025 press reelase). (Source: Standard Lithium, March 2025 press release)

3 Oct 2025

3 Sept 2025 - Lithium clay developer Ioneer Ltd. (ASX: INR | NASDAQ: IONR) announced updated economics, reserves, and resources for its 100%-owned Rhyolite Ridge Lithium-Boron project in Nevada, which replaced prior numbers in June 2025 DFS. Contained lithium in mineral reserves by +~4.7% to 2.01 Mt lithium carbonate, while overall resources +~2.4% to 4.07 Mt lithium carbonate. NPV grew substantially to US$1.9b (from $1.4b), but this appears largely due to a higher lithium price of US$23,012/t lithium hydroxide (was $13,423/t lithium hydroxide in June 2025), from initial capex of $1.7b that remained unchanged and low All-in-sustaining-costs of US$5,626/t lithium carbonate equivalent. And this time the NPV sensitivity to metal price was provided in the study/announcement, which we were able to retrieve and add to our Peer Table’s 9-company lithium clay developer peer group by P/NAV (taken as market cap/NPV). At our reference lithium hydroxide price of US$24,000/t (which we assume to be a 20% premium to our reference lithium carbonate price of US$20,000/t lithium carbonate for peer comparison purposes), INR’s NPV rises to US$2.05b with P/NAV 0.12x (on 5 Sept), before closing month (endign 3 Oct) up +42% (in-line with group median +44%), resulting in INR being a premium stock in the group with P/NAV of 0.15x (vs. mean 0.087x and median 0.012x). This might suggest INR is one of the more likely Nevada Li clay projects to get built in the nearer term, especially given the Trump Adminstration’s Department of Energy’s January 2025 announcment of a $996 million loan guarentee for Ioneer.

3 Oct 2025

Rhyolite Ridge All-in Sustaining Costs (AISC) compared to other Projects (Source: Ioneer internal study and Benchmark Mineral Intelligence. Lithium Carbonate price estimate Benchmark Mineral Intelligence 30 April 2025 lithium carbonate spot CIF Asia). (Source: Ioneer)

Disclaimer: Provided for informational and educational purposes on an “as-is” basis, and is not intended as investment advice. For full disclosures, visit www.hostrockcapital.com/disclosures.