- Monthly Metals Mining Rundown - Free

- Posts

- Monthly Metals Mining Rundown for Month Ending 31 Dec 2025

Monthly Metals Mining Rundown for Month Ending 31 Dec 2025

Metal prices surged this month, led by lithium, and followed by silver and PGMs which rose to record highs before correcting; Li closed the month +28% higher to nearly US$17,000/t Li carb, leading to a median Li producer peer group monthly performance of +13%, while Li brine junior miners also gained - outperforming the Li hard rock peers. Silver rose +27% to $71.50/oz Ag, platinum +23% to $2,050/oz Pt, palladium +13% to $1,630/oz Pd, and rhodium +13.5% to $9,025/oz Rh, which together helped most silver and PGM mining stocks rise - led by PGM developers rising a median +20% and silver explorers a median of +17%; Base metal prices also rose, led by nickel +13% to ~9-month high of $7.60/lb Ni followed by copper and cobalt +9% to $5.64/lb Cu (after retreating from record highs of almost $6/lb Cu) and $23.95/lb Co, which helped most larger cap Ni, Cu, and Co miners rise +10% or more; Gold rose only +2.4% during the month to $4,318/oz (after retreating from record highs around $4,500/oz) which helped most gold stocks rise by multiple percent; Includes covered announcements by: GTWO, BML, HMMC, HSTR, TLO, LM1, SICO, MAU, A1G, TAU, CTGO, DV, LIFT, WR1, CNC, STN.

This past month’s metal price and top & bottom mining company peer group movers include:

31 Dec 2025

This past month’s top & bottom 40 performing metals mining stocks (out of Peer Table’s 500) include (share price rounding errors apply, as sourced from Google Finance):

Coverage of metals mining announcements incorporated into this month’s Peer Table (resource updates, economic studies, changes in attributable project ownership) include:

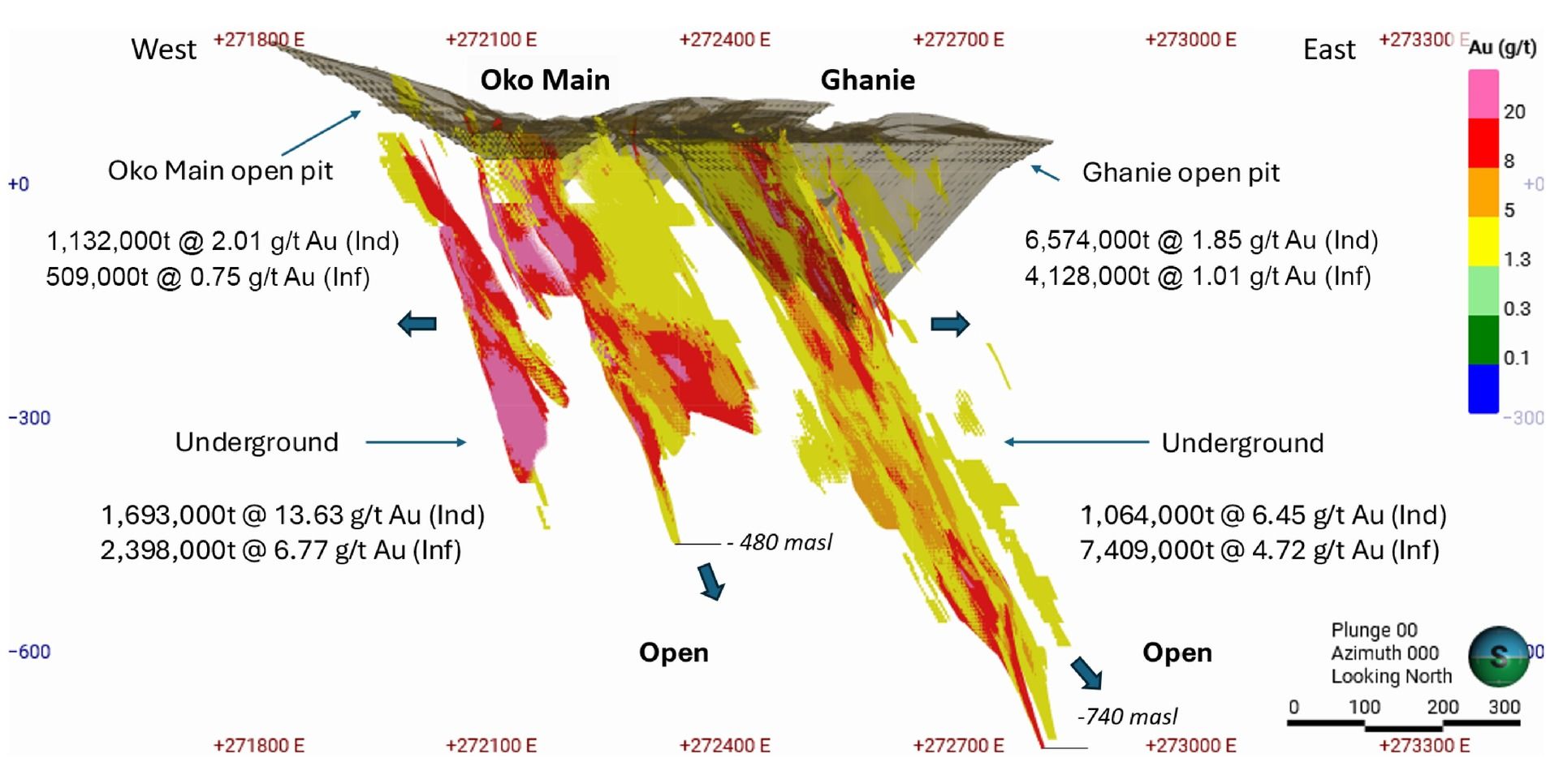

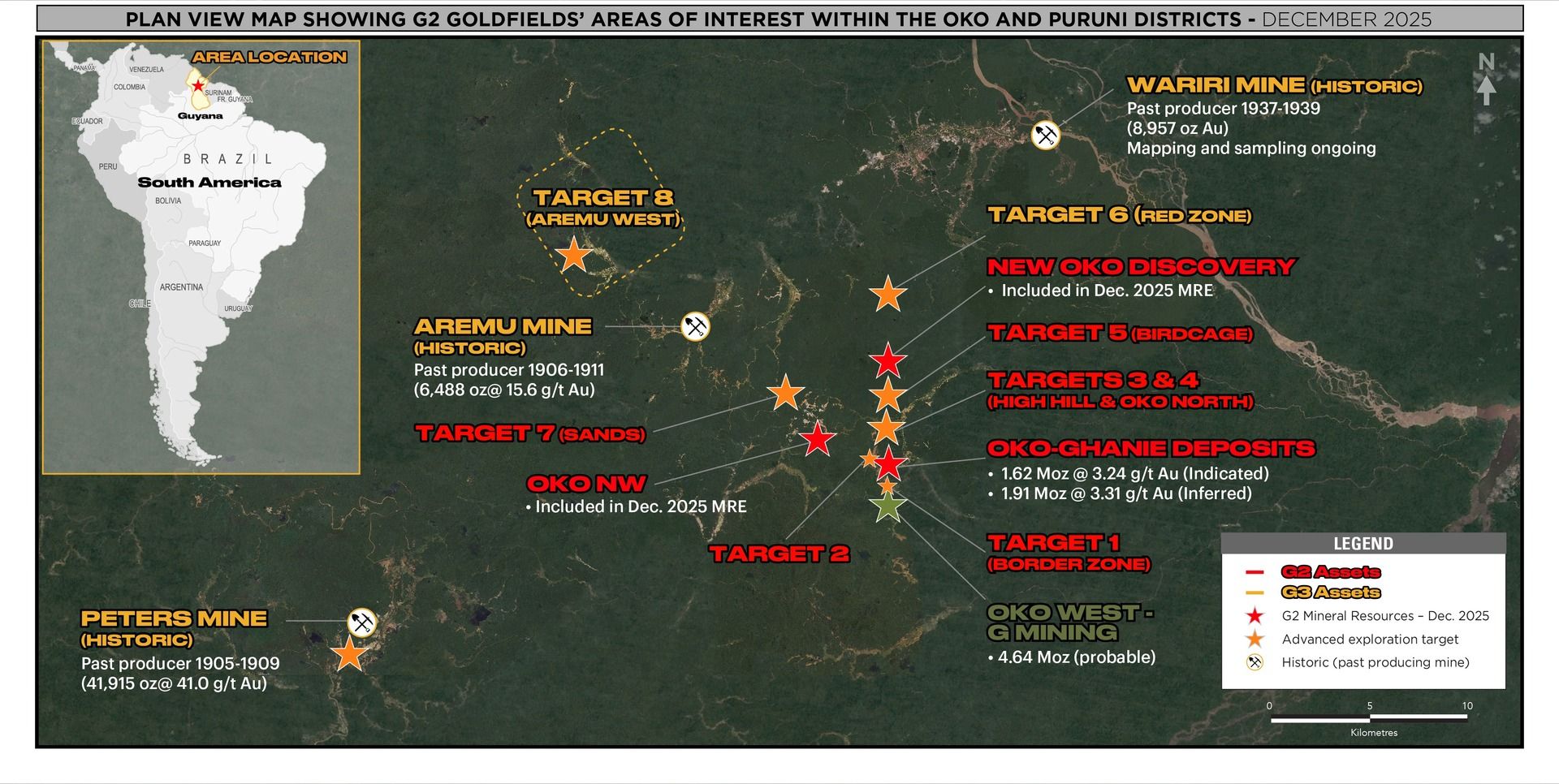

Former gold explorer – now gold developer – G2 Goldfields Inc. (TSX:GTWO) announced on 18 Dec a maiden PEA for the high-grade Oko gold project in South America’s Guyana, which included an updated resource estimate that grew contained ounces by ~13.5% to 3.53 Moz, including 1.6Moz @ 3.24g/t (indicated) and 1.9Moz @ 3.31 g/t (inferred). Study contemplates a 14-year open pit and underground operation with annual gold production of 281,000 oz with low AISC of US$1,137/oz Au. Economics were robust with NPV5 of US$2.6b from initial capex of $664m (including 20% contingency) at US$3,000/oz Au – with the NPV improving by more than 50% to $4.2b at higher gold price $4,000/oz Au. GTWO stock is up +29% over past month (ending 31 Dec) after this news (vs. gold developer median +8%), to C$6.37/sh, market cap C$1.6b, and P/NAV 0.28x – slightly above our 74-company gold developer mean 0.24x and well above median 0.15x – all at our 3-month trailing gold price US$4,047/oz Au. And this is still a starter study based on a starter resource with strike length ~2km, as it excludes several newer zones recently discovered/drilled that could help extend the deposit by up to an additional ~8km to the north – possibly being incorporated into future resource estimates and studies as GTWO continues to explore while also aggressively advancing the project to feasibility and construction.

31 Dec 2025

Silver developer Boab Metals Limited (ASX:BML) announced last week (on Friday 19 Dec) that is has exercised its option to acquire the remaining 25% interest in its flagship Sorby Hills silver-lead project in Western Australia, from (former) partner Yuguang. Consideration includes A$12m cash payment to earn the remaining 25% for 100%, before deferred milestone payments of A$5.5m and A$5.0m 12 months and 18 months after commencement of production. The NPV8 from its 2024 Front End Engineering Design (FEED) study (more detailed/advanced than feasibility) is now 100% attributable to BML, and at our 3-month trailing average silver price of US$51.25/oz Ag, the pre-tax NPV8 (from FEED study) now increases to US$897m (70% of this is $628m and is used for P/NAV for comparison purposes), translating to a P/NAV of 0.24x - a 51% discount to our 14-company silver developer peer group median of 0.50x (at same $51.25/oz Ag) - after BML stock (surprisingly) fell -8% over past month (ending 31 Dec) vs. silver developer median gain +9%, to A$0.47/sh, market cap A$235m or US$1.28/oz AgEq resource (a 48% discount to silver developer median market cap/oz $2.47/oz AgEq).

31 Dec 2025

Gold developer (and new gold producer) Hemlo Mining Corp. (TSXV:HMMC) on 18 Dec announced its first gold pour at its Hemlo gold mine in Ontario, after just completing the acquisition from Barrick Mining Corporation less than one month ago. Hemlo has a 2024 PFS prepared by large consulting conglomerates SLR Consulting and WSP which employ some 4,500 and 75,000 people globally. HMMC stock has gained +29.5% over the past month ending 31 Dec (vs. developer average gain of +8%), to C$5.18/sh, market cap C$1.5b, P/NAV (market cap/NPV) of 0.48x at 3-month trailing gold price US$4,047/oz – which is around the upper-quartile range of our 73-company gold developer peer group, but looks QUITE CHEAP given this mine (and mill) is ALREADY BUILT and has been producing since November 26th (and is well on its way to achieving full-scale commercial production and mid-tier gold producer status, which would typically warrant a higher P/NAV in the ballpark of 0.6-1x).

31 Dec 2025

Gold developer (with growing small-scale production) Heliostar Metals Ltd (TSXV:HSTR) announced on 11 Dec an updated PFS for its large, 100% owned Cerro del Gallo project in Mexico, which is next in-line for development after its (also-large, flagship) Ana Paula project - all in Mexico where HSTR holds another project (San Antonio) and 2 past-producing/operating mines with growing small-scale gold production (La Colorado and San Agustin) - for 5 projects/mines in total, all with recent economic studies including NPVs. This announced Cerro del Gallo PFSU reported an after-tax NPV5 of US$424m at US$2,300/oz Au from initial capex of only US$195.3m for heap leach mine. This NPV is slightly lower than in the 2020 PFS (at apples-to-apples metal pricing), but cost estimates and mine plan are now updated/tightened. Combined post-tax NPV for all 5 projects at 3-month trailing average gold price US$3,914/oz stands at US$3,709m, and based on a (basic) HSTR market cap of US$488m (after stock fell -2% over last month ending 31 Dec vs. peer average +8%), stock trades at P/NAV 0.13x - a 17% discount to 72-company gold developer group median 0.15x (but HSTR actually has growing small-scale production from ongoing operations unlike most other developers in this group, so this P/NAV should continue to rise, ultimately reaching 0.6-1x upon achieving mid-tier gold producer status).

31 Dec 2025

Former nickel and copper developer – now copper and nickel producer – Talon Metals Corp. (TSXV:TLO) on 19 Dec announced the acquisition of producing Eagle Mine and nearby Humboldt Mill in the Upper Peninsula of Michigan, from Copper producer Lundin Mining Corporation (TSX:LUN). Consideration will be 275.15m shares TLO representing 18.73% of the company after a US$5.6m concurrent private placement with Lundin Family Trust for another 1.26%, with Lundin Mining to own 19.99% after the (small) position it already held. These 275.15m shares translate to a value of C$115.6m at 18 Dec closing TLO share price of C$0.42. TLO enjoyed a premium valuation (market cap had been C$481m or US$0.84/lb NiEq resource) for its 51% interest in PEA-stage high-grade Tamarack Ni-Cu project in Minnesota, where earlier this year it discovered a major extension (Vault Zone) to the Tamarack Ni-Cu(-Co-PGM-Ag-Au) system that is not yet in resources. And the company is now leveraging this premium to graduate to the producer peer group by adding Eagle, from which cash flows can be used to help fund development activities at Tamarack. Including the concurrent private placement, TLO’s basic shares will grow by ~25% to 1.46 B shares (before a planned share consolidation) and its attributable NiEq resources will grow by ~18% (from Eagle) to ~585 Mlbs NiEq (~50% from Ni, 34% from Cu, rest Co, Ag, Au, Pd, Pt). TLO stock traded up +35% intraday (19 Dec), before closing the month (ending 31 Dec) up +33% to C$0.60/sh, proforma market cap C$878m, and proforma market cap/lb US$1.27/lb NiEq or $0.93/lb CuEq – at the top of our 24-company copper producer peer group (pending the future addition of Tamarack’s new Vault zone to resources, which management suggests has geometry, scale, and copper enrichment up to 4x greater than what’s in Tamarack's existing resource area).

31 Dec 2025

Lithium hard rock explorer Li-FT Power (TSXV:LIFT) announced on 15 Dec the acquisition of fellow Li hard rock explorer Winsome Resources Ltd (ASX:WR1) and its Adina project, alongside a separate announced acquisition of 75% of the Galinee project from Azimut Exploration Inc. (AZM) (TSXV:AZM) - both all-stock deals for projects in Quebec (where LIFT already holds other Li projects). Adina already hosts resources of 61.4Mt @ 1.14% Li oxide indicated and 16.5 Mt @ 1.19% Li oxide inferred, which is constrained by the neighboring Galinee property boundary. So this deal should allow LIFT to extend the Adina MRE onto the Galinee property, and a concurrent C$30m subscription receipt offering was also announced to fund drilling for this, and another C$10m private placement to fund exploration and development at LIFT’s prior flagship Yellowknife project in NWT - both led by Canaccord Genuity. Altogether with both acquisitions and financings, LIFT’s basic shares will grow by 80% to ~85.2m shares. And the deal is accretive on market cap/t LCE (even after financing) as LIFT’s mineral resources (from Yellowknife project) will more than double to 2.88 Mt LCE (from 1.2 Mt LCE). LIFT stock (surprisingly) dropped -8% intraday 15 Dec (vs. peer group median drop of -1%), before closing month (ending 31 Dec) down -3.6% (vs. peer group median flat +0%) to C$4.33/sh, proforma market cap C$369m, and proforma market cap/t LCE drops >25% to US$93/t LCE (was $138/t LCE pre-deal) - now just above group median $61/t LCE, and this excludes a number of LIFT’s other early-stage (pre-resource) projects. WR1 shareholders received 68% premium to 20-day VWAP and WR1 stock closed up +8% on 15 Dec, before closing the month ending 31 Dec up +48% to A$0.46/sh.

Nickel and cobalt developer Canada Nickel Company (TSXV:CNC) announced on 18 Dec initial resource estimates for its Midlothian and Bannockburn nickel sulphide projects, outside of Timmins, Ontario, which make up the company’s 8th and 9th deposits with delineated mineral resources, both of which were at the higher grade end of the range for the group of Timmins projects (which are all fairly low grade overall). Midlothian delivered 595 Mt inferred @ 0.28% Ni (and 0.011% Co) and Bannockburn had 63 Mt indicated @ 0.28% Ni (0.009% Co) and 129 Mt inferred @ 0.27% Ni (and 0.010% Co). These estimates grow the company’s resource endowment by ~14% to 51.6 Blbs NiEq (89% from Ni, 11% from Co, excluding other low-grade/minor byproduct metals). CNC stock traded up slightly +1% on 18 Dec (in-line with peers) following this news, before closing month (ending 31 Dec) up +16% (in-line with group median) to C$1.40/sh, market cap C$323m, and market cap/lb of US$0.005/lb NiEq – now once again at the bottom of our 15-company nickel developer peer group (a discount partly justified by CNC’s relatively large inventory of fairly low grade resources) – and a sharp 93% discount to group median $0.065/lb NIEq. On P/NAV considering CNC’s 2023 FS for flagship Crawford (accounting for roughly/only half of the company’s mineral resources), CNC trades at 0.095x – a 40% discount to our nickel developer group median 0.16x (at our reference Ni price of US$9.50/lb Ni).

Gold developer Saturn Metals Limited (ASX:STN) announced yesterday (17 Dec) a PFS for its flagship 100%-owned Apollo Hill project near Leonora in Northern Goldfields of West Australia, outlining a long-life, open pit mine and 10tmpa heap leach operation, with a maiden ore reserve of 104.6 Mt @ 0.47 g/t Au for 1.59Moz Au and a fairly low strip ratio of 2.4:1. The NPV was slightly lower than the 2023 PEA, as can be expected on this key de-risking PFS step with tighter cost estimates and mine design. Reported base-case pre-tax NPV8 was A$973m at A$4,300/oz Au from initial capital of A$472m with relatively low AISC of A$2,464/oz Au. And this NPV increases substantially to A$2.4b at the reported spot gold case A$6,200/oz Au. STN stock has traded down slightly in the two sessions following this announcement, and closed the month (ending 31 Dec) down -3.8% vs. gold developer group median gain of +8%, to A$0.50/sh, market cap A$271m, and P/NAV (taken as market cap/70% of pre-tax NPV from PFS) of 0.17x – a hair above our 72-company gold developer peer group median 0.15x (both at 3-month trailing gold price US$4,047/oz), which looks cheap considering this now-advanced PFS stage project (given roughly half of our developer group is made up of earlier-stage PEAs/Scoping studies), and which paves the way for a DFS in 2026 alongside progression of permitting activities on journey towards production.

9 Dec 2025 - Silver explorer Silverco Mining (TSXV:SICO) announced an updated mineral resource estimate (MRE) for its flagship, 100%-owned, Cusi project - Silver explorer Silverco Mining (TSXV:SICO) announced an updated mineral resource estimate (MRE) for its flagship, 100%-owned, Cusi project located 90km NW of silver (and gold) producer First Majestic Silver Corp. (TSX:AG) Los Gatos mine in Mexico. The MRE reflected a reported 28% increase in M&I resources to 41 Moz AgEq, a 22% increase in M&I grade to 262 g/t AgEq, and a 9% increase in M&I tonnes to 4.9Mt, compared to the prior (historic) 2020 MRE, after depletion of 0.81Mt @ 182 g/t AgEq containing 4.8 Moz AgEq. The resource estimate only included a portion of 2025 drilling, and excludes recent results such as 319 g/t AgEq over 8.8m and 273 g/t AgEq over 12.4m (hole CU-23-37). Before depletion, the deposit still grew by ~5% to 67 Moz AgEq (0.82 Moz AuEq) with a high 82% of the metal value coming from silver (well above 27-company silver explorer median silver dominance of 48%) - with remaining 8% from Zn, 5% from Au, 5% Pb. SICO stock gained +16% on 9 dec vs. silver explorer median gain of +6.2%, before rising another +10% on 10 Dec (intraday) vs. peer median flat +0% (intraday), before closing the month ending 31 Dec up a HUGE +69% (vs. silver explorer group median +17%) to C$9.71/sh, market cap C$317m, and market cap/oz US$3.46/oz AgEq ($273/oz AuEq) - a premium to group mean US$1.62/oz AgEq for SICO’s rare primary silver resource (with 82% of metal value coming from silver at 3-month trailing average metal pricing, with no recovery factors).located 90km NW of silver (and gold) producer First Majestic Silver Corp. (TSX:AG) Los Gatos mine in Mexico. The MRE reflected a reported 28% increase in M&I resources to 41 Moz AgEq, a 22% increase in M&I grade to 262 g/t AgEq, and a 9% increase in M&I tonnes to 4.9Mt, compared to the prior (historic) 2020 MRE, after depletion of 0.81Mt @ 182 g/t AgEq containing 4.8 Moz AgEq. The resource estimate only included a portion of 2025 drilling, and excludes recent results such as 319 g/t AgEq over 8.8m and 273 g/t AgEq over 12.4m (hole CU-23-37). Before depletion, the deposit still grew by ~5% to 67 Moz AgEq (0.82 Moz AuEq) with a high 82% of the metal value coming from silver (well above 27-company silver explorer median silver dominance of 48%) - with remaining 8% from Zn, 5% from Au, 5% Pb. SICO stock gained +16% on 9 dec vs. silver explorer median gain of +6.2%, before rising another +10% on 10 Dec (intraday) vs. peer median flat +0% (intraday), before closing the month ending 31 Dec up a HUGE +69% (vs. silver explorer group median +17%) to C$9.71/sh, market cap C$317m, and market cap/oz US$3.46/oz AgEq ($273/oz AuEq) - a premium to group mean US$1.62/oz AgEq for SICO’s rare primary silver resource (with 82% of metal value coming from silver at 3-month trailing average metal pricing, with no recovery factors).

31 Dec 2025

10 Dec 2025 - Gold explorer Leeuwin Metals Ltd (ASX:LM1) announced a maiden resource for its Marda project in West Australia, amounting to 10.2 Mt @ 1.05 g/t Au for 342,300 oz Au (~20% indicated category), with super low discovery cost of less than A$10/oz Au. LM1 stock sold off -8.6% (on 10 Dec) following this news on relatively light volume (2x avg) vs. ASX gold explorer mean gain of +2.6%, before closing the month (ending 31 Dec) down -10.5% to A$0.17/sh, market cap A$21m, and market cap/oz resource of US$41/oz Au - still a 20% discount to our 92-company gold explorer median $51/oz AuEq.

31 Dec 2025

8 Dec 2025 - Intermediate gold producer Contango ORE (NYSE:CTGO) announced a merger of equals with silver explorer Dolly Varden Silver Corp. (TSXV:DV), in an all-share deal where CTGO and DV shareholders will each own 50% of the combined/merged entity. CTGO recently in 2024 began receiving cash flow from its 30% ownership/JV in Kinross’ (NYSE:KGC) Manh Choh gold-silver mine in Alaska, and CTGO plans to apply the “Direct Ship Ore” (DSO) approach to help fast-track development if its other two, 100%-owned, advanced-stage exploration projects, Lucky Shota and Johnson Tract – both also in Alaska. DSO relies on directly-shipping-the-ore from nearby ports given these projects are not far from the coast. CTGO now also aims to apply this technique to DV’s silver-dominant projects in BC’s Kitsault Valley’s past-producing Dolly Varden silver project and Homestake Ridge silver-copper project – which are also not far from coast. This deal will double CTGO’s shares outstanding, and more-than-double it’s mineral (resource) inventory from 1.33Moz AuEq (1% Ag, 81% Au, my metal value at 3-month trailing average pricing) to 3.12 Moz AuEq (26% from Ag, 66% Au, rest Cu-Zn-Pb). And although Manh Choh’s silver production is minimal, these additional near-development silver resources allow us to also add CTGO to our silver producer peer group. CTGO stock closed down -1% on 8 Dec following this news (in-line with int. gold producer median loss of -1%), before closing the month (ending 31 Dec) up +8% (in line with median +8.6%) to US$26.41/sh, pro forma market cap US$796m, or $249/oz AuEq – a 9% discount to both our 58-company intermediate gold producer median US$273/oz AuEq and our 21-company silver producer median US$274/oz AuEq – and a 55% discount to senior gold producer group median $565/oz AuEq (a group that could acquire CTGO if it succeeds in bringing its new portfolio of DSO projects online – which are also open for growth including from ongoing 18,000m Lucky Shot in Alaska that’s fully-permitted with a DSO feasibility study and construction decision due in 2027, AND from 56,000m recently completed in 2025 at Homestake deposit in BC that hit 1,422 g/t Ag over 21.7m, among other high-grade intercepts).

31 Dec 2025

31 Dec 2025

1 Dec 2025 - Gold developer Thesis Gold Inc. (TSXV:TAU) announced PFS results for its flagship 100%-owned Lawyers-Ranch project in BC, which included a maiden reserve of 76Mt @ 0.97 g/t Au and 28g/t Ag (1.33 g/t AuEq) for 3.2Moz AuEq, including an open pit component of 42Mt @ 0.83g/t Au and 20g/t Ag (1.08g/t AuEq) with a strip ratio that was 8% improved to 4.6:1 (was 5:1 in 2025 PEA). Reported post-tax NPV5 was C$2.4b at US$2,900/oz Au from initial capital of C$736m with low AISC of US$1,185/oz AuEq. This key de-risking PFS milestone coincided with a slight 12% drop in NPV at apples-to-apples metals pricing (at our 3-month trailing average gold price of US$3,914/oz AuE) to US$2.9b, reflecting a P/NAV (market cap/NPV) of 0.13x (at C$2.19/sh) - exactly in-line with our 72-company median 0.15x. And this was after Thesis stock traded down -3% over month ending 31 Dec) after this news vs. peer group median gain +8%.

31 Dec 2025

28 Nov 2025 (last Friday, after-market) - Gold developer Montage Gold (TSX:MAU) announced the acquisition of gold explorer African Gold (ASX:A1G) in an all stock deal, where A1G shareholders will receive 0.0628 shares MAU per share of A1G, and will own ~7.8% of the combined entity. MAU looks to be leveraging its dominant valuation (with a market cap exceeding C$3b, a market cap/oz resource that had been US$433/oz AuEq vs. median $58/oz, and P/NAV that had been 0.47x vs. median 0.13x at our 3-month trailing avg gold price $3,914/oz) to grow its position in the particularly-geologically-attractive West Africa jurisdiction of Cote d’Ivoire, where the Company already holds the LARGE OPEN PIT feasibility-stage Kone gold project – which had been included in our top 15 gold open pits by grade-strip in our 17 Aug note here: https://lnkd.in/da92s5nh with 509 impressions on LinkedIn and in 21 Aug video here: https://lnkd.in/dpauujsM with 1,735 impressions, all of which helped MAU stock rise +43% over the past 3 months (vs. 70-company gold developer peer group median +32%).

Transaction price equates to ~A$0.50/sh A1G for a 54% premium to 10-day VWAP (and to market cap that was around A$168m and $183/oz Au).

MAU will get A1G’s prize asset – its flagship Didievi project which hosts an inferred resource 12.4Mt @ 2.5g/t Au containing 989koz Au.

This looks like a win-win deal as MAU will add 1Moz of inferred resources for US$281/oz, which is a 35% discount to MAU’s pre-existing market cap/oz of US$433 (and also a 54% premium to A1G’s prior $183/oz).

MAU stock traded up flat the week (ending 5 Dec) roughly in-line with peers, before closing month (ending 31 Dec) up +12% (vs. peer group median +8%) to share price C$9.88, and proforma market cap C$3.9b for combined entity, with a P/NAV 0.56x (at 3-month trailing gold) for ~100% discount to ~1x typical for producers) and market cap/oz US$457/oz – still a 19% discount to the senior gold producer peer group (median $565/oz) that ought to acquire MAU when the time is right.

31 Dec 2025

Disclaimer: Provided for informational and educational purposes on an “as-is” basis, and is not intended as investment advice. For full disclosures, visit www.hostrockcapital.com/disclosures.