- Monthly Metals Mining Rundown - Free

- Posts

- Monthly Metals Mining Rundown for Month Ending 31 Oct 2025

Monthly Metals Mining Rundown for Month Ending 31 Oct 2025

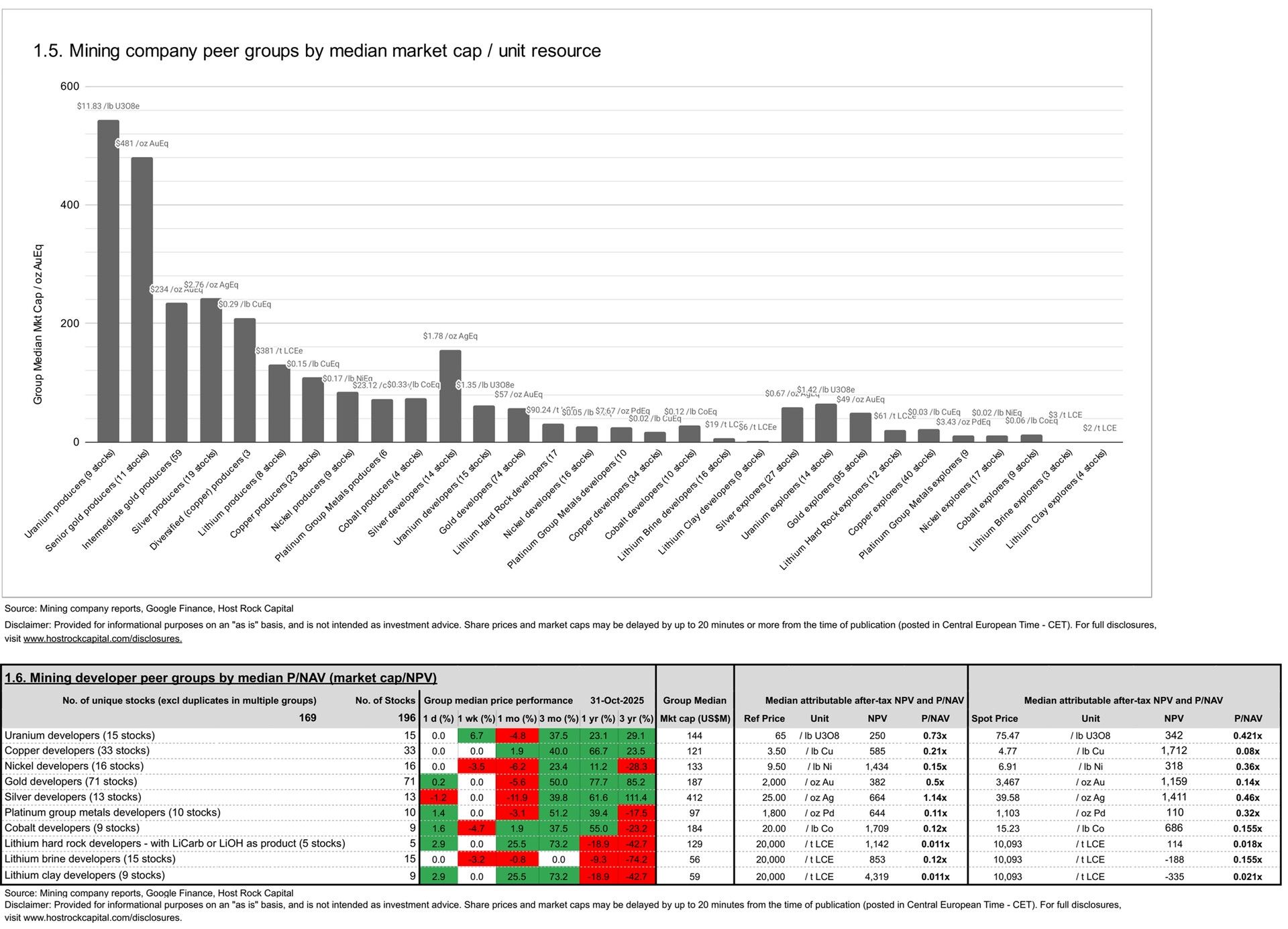

Most metal prices rose during October, led by cobalt, lithium, copper, silver, and gold; Lithium mining stocks stood out, led by producers and hard rock juniors, while uranium producers also gained despite uranium price being largely flat; Most cobalt and copper stocks also gained alongside underlying metal prices; Gold and silver mining stocks mostly fell while underlying metal prices gained.

This past month’s metal price and top & bottom mining company peer group movers include:

31 Oct 2025

31 Oct 2025

This past month’s top & bottom 40 performing metals mining stocks (out of Peer Table’s 500) include (share price rounding errors apply, as sourced from Google Finance):

Coverage of metals mining announcements incorporated into this month’s Peer Table (resource updates, economic studies, changes in attributable project ownership) include:

30 Oct 2025 - Gold explorer Turaco Gold (ASX:TCG) announced an updated mineral resource estimate for its flagship Afema project in Cote d’Ivoire, which grew ounces by 14% to 4.06Moz - and at a higher grade of 1.2 g/t Au. And this excludes 11,000m of drilling recently completed to be incorpprated in another update Q1/26 which will form basis for PFS due Q2/26. TCG stock rose +3.4% intraday on 30 Oct after this news, before finishing the week (ending 31 Oct) +2.2% (vs. group median flat +0%) to 47c/sh, market cap A$489m, and market cap/oz of US$79/oz Au - in-line with our our 94-company gold explorer peer group mean $79/oz AuEq (and above median $49/oz) - sounds cheap given its large size and near-development stage.

31 Oct 2025

28 Oct 2025 - Former gold explorer - now gold developer - Scottie Resources Corp. (TSXV:SCOT) announced PEA results for its 100%-owned past-producing Scottie gold mine project in BC, which contemplated XRF ore sorting (after small-scale ore sorting test results were announced 1 April 2025) and Direct Shipping of Ore (DSO) from the Stewart bulk shipping facility 40km from the from the mine to be shipped overseas according to negotiated terms in an existing offtake agreement (announced 7 July 2025). Post-tax NPV5 was C$216m at US$2,600/oz from initial capex of C$129m, with NPV increasing to C$668m at US$4,200/oz Au. And these NPVs rise by ~50% in an alternative scenario that relies on nearby toll milling INSTEAD of Direct Shipping of Ore (for which there is no agreement), providing some optionality. SCOT stock traded flat/down -1.2% on 28 Oct after this news (a hair below 94-company explorer mean +1.2%), before closing the week (ending 31 Oct) at C$1.67/sh, market cap C$108m, and P/NAV 0.50x - in line with 71-company gold developer median 0.50x and 37% discount to mean 0.79x - at our reference gold price US$2,000/oz. Feasility study next - expected H1/27.

31 Oct 2025

24 Oct 2025 - Gold explorer (and copper-zinc explorer) Tartana Minerals Limited (ASX:TAT) announced a maiden gold resource for its Cardross gold project in Australia. The inferred resource amounts to 50.4Mt @ 0.31g/t for 502 koz Au, with low cutoff grade of 0.1g/t and a (conservative) top cut of (only) 1.22 g/t Au. Together with TAT’s neighbouring Mountain Maid’s 591.5 koz Au @ 0.25 g/t, the area now hosts more than 1Moz. The release also mentions ore-sorting test work has been carried out at nearby Wandoo project with similar minerlization by Green and Gold Minerals (see prospectus dated 8 Jul 2025) which demonstrated a whopping 8x grade increase while retaining 91% of the metal. Together with TAT’s other copper and zinc projects which host 45 kt (99 Mlbs) Cu and 39 kt (86Mlbs) Zn, TAT now has resources of 1.26Moz AuEq (918 Mlbs CuEq) across 3 projects at 3-month trailing average metal pricing with no recovery factors, which are now 87% from Au, now only 11% from Cu, rest-Zn. TAT stock traded up a HUGE +29% on 24 Oct following this news to 5.4c/sh, before closing the month ending 31 Oct flat +0% at 4c/sh, market cap A$9m, and market cap/oz of US$4.9/oz AuEq ($0.007/lb CuEq) - still a steep 90% discount to our 94-company gold explorer peer group median $49/oz AuEq (and also still a steep 77% discount to our 40-company copper explorer median US$0.030/lb CuEq).

31 Oct 2025

20 Oct 2025 - Copper developer Arizona Sonoran Copper Company Inc. (TSX:ASCU) announced PFS results for its flagship Cactus project outlining a long-life, low-cost operation in Arizona. The NPV took a slight hit compared to the old 2024 PEA, as might be expected from this key derisking step with maiden ore reserve more refined cost estimates. Reported post-tax NPV was US$2.3b at base case $4.25/lb from initial capital of $977m for conventiona open pit heap leach with SXEW with LOM all in operating coosts of $2.01/lb. ASCU stock gained +12% on 20 Oct intraday following this announcement to C$3.49/sh, before closing the month (ending 31 Oct) up +29% (vs. copper developer group median gain +1.9%) to C$3.95/sh. market cap C$712m, and P/NAV 0.40x at our reference copper price $3.50/lb - in between our 34-company copper developer median and mean 0.21x and 0.67x (at same $3.50/lb).

31 Oct 2025

20 Oct 2025 - Intermediate gold producer IAMGOLD Corporation (NYSE:IAG) announced the acquisition of two juniors with properties that are contiguous and/or near to its existing 8.3Moz Nelligan and 0.57Moz Monster Lake gold properties: (1) gold explorer Northern Superior Resources (TSXV:SUP) with its 3Moz attributable ounces spread across Chevrier (100% owned by SUP), Philibert (75%), and Croteau Est (100%), and (2) early-stage (pre-resource) gold explorer Mines D’Or Orbec (TSXV:BLUE) with its prospective Muus property. SUP shareholders will receive 0.0991 IAG shares and C$0.19 cash for each share of SUP (roughly ~90% shares, 10% cash), for a 27.4% premium to 20-day VWAP. IAG and SUP to own 97% and 3% of pro forma company. IAG basic shares to increase by +3.0% to ~592.26 while its attributable mineral resource inventory will increase by ~+9.5% to 35.9Moz - making the deal accretive for IAG shareholders on resource ounces per share IAG. IAG traded up +3.6% on 20 Oct intraday following this news to US$13.76/sh, before closing the month ending 31 Oct down -11% (vs. int. gold producer median loss of -1.5%), pro forma market cap US$6.86b, and market cap/oz resource (reduced by this deal to) US$200/oz Au - for a 15% discount to our 60-company intermediate gold producer median US$234/oz AuEq.

31 Oct 2025

16 Oct 2025 - Lithium clay developer American Battery Technology Company (NYSE:ABAT) announced a PFS for its flagship Toponah Flats project in Nevada. Economics took a slight hit compared to the 2024 Initial Assessment of Cash Flows (like a PEA), although the company swapped out the NPV10 sensitivity for NPV8 sensitivity – so the reported after-tax NPV8 at our reference Li Hydroxide (LiOH) price of US$24,000/t LiOH according to the NPV sensitivity provided in the PFS came in only slightly below the prior (more conservative) NPV10 at same ref price $24,000/t LiOH (at apples to apples discount rate of 10% around this reference price $24,000/t, the NPV took a larger hit in the ball park of ~30%). Following this news, ABAT stock fell a combined ~45% on 16 and 17 Oct (while Lithium Americas NYSE:LAC fell ~40%), before finishing the month ending 31 Oct down -1.2% (vs. Li clay developer medain gain of +19%) creating a possible buying opportunity for investors seeking further derisking steps towards production for this top-tier Li clay development project that was already selected by the Trump Administration for fast-track permitting as a critical mineral property project (see 30 June 2025). As such, ABAT trades at P/NAV of 0.21x according to its NPV8% at our reference LiOH price $24,000/t – near the top of our 9-company Li clay developer peer group – and a 16% discount to LAC/Thacker Pass’s P/NAV of 0.25x.

17 Oct 2025

17 Oct 2025 - Mexican gold developer (and small-scale gold producer) Heliostar Metals Ltd (TSXV:HSTR) announced updated economics for its La Colorada mine (with ongoing small-scale production), including the drill results from Nov 2024 to Mar 2025 from ongoing ~20,000m drill program.

This study replaces the prior study announced 14 Jan 2025, that we covered here: https://lnkd.in/dSG4PuQJ, with >400 impressions (HSTR stock is up more than 3x since then). The study improved economics slightly at La Colorada – boosting that mine’s NPV by some ~$10m at spot gold price. Including the Jan 2025 study for San Agustin (where small-scale production is also set to restart soon), the 2023 PFSU for large Ana Paula project, the 2025 PEA for San Antonio, AND the 2020 PFS for Cerro del Gallo by Argonaut Gold (5 studies), HSTR traded down -3% during the month ending 31 Oct (vs. gold developer median loss -5.6%) to C$1.83/sh, market cap C$467m, P/NAV of 0.24x at our reference gold price of $2,000/oz, which is a 53% discount to our 71-company gold developer peer group median 0.50x (at same $2,000/oz) – making it one of the cheapest looking gold “developers” in the group (HSTR actually produces). And so this P/NAV should continue to rise/approach ~1x (from 0.24x), as HSTR continues to graduate to full commercial production – initially at its La Colorada and San Agustin mines.

31 Oct 2025

9 Oct 2025 - Former PGM explorer - now PGM developer - Clean Air Metals Inc. (TSXV:AIR) announced PEA results for its Thunder Bay North Critical Minerals (Pt-Pd-polymetallic) project in Ontario. The study contemplates an 11-year mine life producing 2.5ktpd and yielded a post-tax NPV8 of C$157.5m from initial capital cost of C$89.5m (including 25% contingency), in a toll milling scenario at Impala Canada (Impala Platinum, JSE:IMP)’s Lac-des-Iles (LDI) mine located 65km away where production is due to cease, and AIR hopes to take advantage of that (however there is no certainty that any business arrangement with Impala will be reached). And while this project will be mined as an underground deposit which typically generates little tailings, the grade is not so high and so a considerable amount of tailings will be generated, although notably there is no capex allowance for the LDI site - which may require some additional tailings water management infrastructure at some point in order to receive the additional tailings from AIR. So we await future studies with more detail on water management at DLI and more concrete arrangements with DLI. Mineral resources were also updated and grew slightly from 2.8 Moz PdEq to 3.0 Moz PdEq (0.96 Moz AuEq), which are ~30% from Pt (fairly high vs peers), and ~24% from Pd at our 3-month trailing average prices with no recovery factors, rest Cu, Ni, Au, Ag. AIR stock traded flat +0% this past month ending 31 Oct (vs. PGM developer group median of loss of -3%) to 7c/sh, market cap C$16m, market cap/oz resource of US$3.9/oz PdEq ($12/oz AuEq) - a 50% discount to our 10-company PGM developer peer group median $7.7/oz PdEq ($24/oz AuEq) and slight premium to PGM explorer peer group median $3.4/oz PdEq ($10.8/oz AuEq).

31 Oct 2025

7 Oct 2025 - Gold developer P2 Gold Inc. (TSXV: PGLD | OTCQB: PGLDF) announced an updated PEA for its 100%-owned Gabbs gold-copper project in Nevada. The press release quite clearly and transparently states everything is the same as the 2024 PEA (9mtpa oxide heap leach + SART + ADR operation for 5 years, before adding a 4mtpa mill in year 6 for sulfides, at which time oxide heap leach decreases to 5 mpta, for constant 9 mpta in total), except for the heap leach recoveries, which increased to 85% (from 78%) for gold, to 67% (from 54%) for copper, and to 60% (from 45%) for the trace silver, as a result of the phase 3 met test work (see news release dated 11 Aug 2025) which used more cyanide. These subtantial increases to heap leach recoveries translated to a slight improvement in economics compared to the 2024 PEA, despite capex and opex both increasing slightly. Reported post-tax NPV at reported spot of $3,885/oz was US$2.25b (up 8% from $2.1b in last study) from initial capex of US$383m. HOWEVER, the mine plan in the 2024 had been preliminary, and states that waste rock storage facilities had not been designed in detail. FURTHERMORE, after a closer look at the 2024 PEA in an attempt to gage the additional pond area that would be required for the additional cyanide degredation, and the additional leach pad liner requirements for the higher cyanide concentration, we discovered that not only did the 2024 PEA omit costs and space for ponds, it did not not account for ANY leach pads, NOR did it account for the aformentioned dry stack tailings impoundment with conveyor belts. So while the folks at Kappes, Cassiday & Associates had improved the metal recoveries in the phase 3 test work in this PEA they prepared, the mine plan and infrastructure that had been designed/provided by P&E Mining Consultants Inc. was not synced/updated (after it had already glossed over a number of key items making it quite light on capex). So this PEA’s reported initial capex of $383m can be expected to rise in future more refined studies. Heap Leach pad capex from the Golder Associates’ 2011 PEA for the Cerro Jumil project in Mexico (now called Esperanza gold project held by Zacatecas Silver TSXV:ZAC) was ~15-17% of initial capex. So perhaps leach pads will add some ~$70m in capex at Gabbs, and maybe tailings filter and additional ponds/liners will add another ~$50m (ball park), for a more realistic capex of $503m (~30% higher) that might be expected in a PFS / next study….which is inconsequential in the grand scheme relative to NPV of $2.25b (TOUCHE / GOOD SKATING! 🤝 🫡 ). PGLD stock traded up +42% this past month ending 31 Oct to 37c/sh, market cap C$80m, and P/NAV (market cap/study NPV) of 0.096x at our reference gold price of US$2,000/oz - a 81% discount to our 69-company gold developer peer group median 0.50x.

31 Oct 2025

Disclaimer: Provided for informational and educational purposes on an “as-is” basis, and is not intended as investment advice. For full disclosures, visit www.hostrockcapital.com/disclosures.