- Monthly Metals Mining Rundown - Free

- Posts

- Monthly Metals Mining Rundown for Month Ending 4 July 2025

Monthly Metals Mining Rundown for Month Ending 4 July 2025

Major gains for PGM prices, smaller gains for other metals; Mining stocks rise, led by major gains for PGM miners at all stages, and U & Li producers

This past month’s metal price and top & bottom mining company peer group movers include:

This past month’s top & bottom 40 performing metals mining stocks (out of Peer Table’s 473) include (share price rounding errors apply, as sourced from Google Finance):

Coverage of metals mining announcements incorporated into this month’s Peer Table (resource updates, economic studies, changes in attributable project ownership) include:

3 July 2025 (intraday) - Gold developer Spanish Mountain Gold (TSXV:SPA) announced results of a PEA for its flagship Spanish Mountain gold project in BC, Canada, which included several changes compared to the prior 2021 PFS, including: larger project scale (now 26 ktpa, was 20 ktpd), improved flowsheet, optimized open pit slopes, upsized power to accommodate future electrification of equipment, filtered/dewatered tailings, and an updated/tightened resource estimate including main deposit Measured and Indicated resources of 292Mt @ 0.44 g/t Au for 4.2Moz Au + Ag credits (total resources are down slightly to ~4.7Moz AuEq). After-tax NPV5% was C$1.0b at US$2,450/oz from initial capital costs of C$1.25b (including $259m project contingency), or at our estimated 3-month trailing average gold price of $3,270/oz NPV was down slightly to US$1.6b. SPA stock traded flat +0% on 3 July intraday following this news (vs. our 67-company gold developer group median that had also been flat +0%), before finishing the week (ending 4 July) up +5.9% (vs. group median +1.7%), and the month (ending 4 July) flat +0% (in-line with group median +0%) to a market cap of C$80m, market cap/oz resource of US$12/oz AuEq (vs. group median $38/oz AuEq) and P/NAV (market cap/post-tax NPV) of 0.035x (vs. group median 0.10x) based on NPV of US$1.67b that was down slightly from old 2021 PFS - at our estimated 3-month trailing average metal prices (US$3,270/oz Au.).

4 July 2025

4 July 2025

1 Jul 2025 - Gold developer Santana Minerals Ltd (ASX:SMI) announced updated PFS results for its flagship Bendigo Ophir project in New Zealand, which adopted a staged and more selective mining strategy compared to the larger-scale, more generalized operation assumed in the 2024 PFS that included more aggressive pre-stripping. Average open pit mill feed in the new study was up 15% to 2.53 g/t Au. Resulting economics were similarly strong as 2024 PFS, with reported after-tax NPV6.5 of A$780M at A$3,500/oz (30% below current price) from pre-production capital of only A$277m (was A$302m). According to the sensitivity of the NPV to metal prices provided in then study, the project NPV went down slightly at our Reference gold price of US$2,000/oz and up slightly at our estimated 3-month trailing average gold price of US$3,144/oz. SMI stock traded up slightly on Canada Day 1 July 2024 following this announcement, before closing week (ending 4 July) up +1.9% (vs. our 67 gold developer median up +1.7%), and closing the month (ending 4 July) flat +0% (in-line with group median flat +0%) at a share price of A$0.55, a market cap A$397m, market cap/oz resource of US$111/oz Au (near upper-quartile range of gold developers), and P/NAV (taken as market cap/after-tax NPV) of 0.26x (similarly near upper-quartile range) with premium appearing to be attributed to the strong economics (from high open pit grade of 2.53g/t and high NPV to capex ratio)and the fairly advanced PFS stage of the project with permitting studies underway, making SMI a good take out target, ether for intermediate gold producer OceanaGold Corporation Gold (TSX:OGC) that has producing mines in New Zealand already and trades much higher at US$275/oz AuEq resource, or for another producer looking to break into emerging mining jurisdiction of New Zealand.

30 June 2025 - Gold explorer Redcastle Resources (ASX:RC1) announced a resource update for its Queen Alexandra and Redcastle deposits that more than tripled total resources to a still rather small 42 koz Au, grading high for an open pit resource at 2.7 g/t, and this includes a pit-constrained 26 koz @ 2.5g/t Au. RC1 also stated that the estimate provides excellent models for further resource delineation, including below the open pit conceptual shells and at other prospects within the Redcastle Project East West fairway. RC1 stock traded flat on 30 June +0%, before also closing week (ending 4 July) flat +0% and month (ending 4 July) flat +0% (in-line with gold explorer median flat +0%) at A$0.007/sh and a market cap/oz resource of US$8.1/oz - a ~68% discount to our 90-company gold explorer peer group median US$25.6/oz.

4 July 2025

30 June 2025 - Gold explorer Gateway Mining (ASX:GML) announced the acquisition of the Yandal gold project (with 400koz resource) from fellow gold explorer Strickland Metals Ltd (ASX:STK) for A$45m in GML shares (1.5b shares), such that STK will own roughly 79% of GML stock. This more than quadruples GML’s shares, and nearly double its resource ounces to 0.91 Moz, and importantly includes an active mining license application for Horse Well resource of 291.5koz that has multiple toll treating option in the region. STK is opting to distribute/issue 80% of these GML consideration shares directly to STK shareholders. GML stock traded flat +0% on 30 June following this news on strong volume (vs. gold explorer median of down -2%), before closing the week flat +0% and month flat +0% (in-line with group median flat +0%) at A$0.027/sh, market cap A$57m (pro-forma, assuming 1.9b GML shares out) and (pro-forma) market cap/oz resource of US$41/oz - in between our gold explorer median and mean US$25/oz and US$55/oz. STK stock also traded flat +0% on 30 June vs. peer group median down -2%, before closing week (ending 4 July) up +7.1% (vs. group median flat +0%) and month (ending 4 July) up +7.1% (vs. peer group median flat +0%) to A$0.15/sh, market cap A$351m and a market cap/oz resource US$33/oz (including, for now, until distributed to shareholders, STK’s entire proposed ~79% equity stake of GML’s 0.91 Moz, which is more than the 400koz it divested with Yandal) - just above group median $25.6/oz and still well below mean US$57/oz.

30 June 2025 - Gold developer Ausgold Limited (ASX:AUC) announced DFS results along with a resource update for its flagship Katanning project in Western Australia, further de-risking the open pit mine plan and paving the way for front-end engineering and project financing. Post-tax NPV5 was A$954m (US$0.62b) at A$4,300/oz (US$2,795/oz) from pre-production capital of A$355m (US$231m) and the updated resource was 2.44 Moz grading 1.11g/t (reserve of 1.25Moz also grading 1.11g/t). Encouragingly, the resource grade improved by 5% on an optimized resource pit shell and overall tighter estimate that resulted in contained resources ounces falling by nearly 20%. Project engineering and economics also appears tighter as the NPV came up some short of that of the 2022 PFS (at apples to apples gold prices). This led to AUC trading down -16% on 30 June, before closing the week (ending 4 July) down -15% and month (ending 4 July) down -7% (vs. group median flat+0%) at A$0.64/sh, market cap of A$227m (US$149m), and a market cap/oz resource of US$61/oz - in between gold developer group median $38/oz and mean $65/oz - for this advanced feasibility stage, near shovel-ready project (pending permitting completion and project financing). On P/NAV (taken as market cap/post-tax NPV), AUC trades at 0.17x - in-line with group mean 0.16x - both at our estimated 3-month trailing average gold price of US$3,270/oz.

4 July 2025

4 July 2025

30 June 2025 - Gold developer Brightstar Resources (ASX:BTR) announced a DFS for its 100%-owned Menzies and Laverton gold projects in Western Australia, where large-scale mining is set to begin in early 2026 through a targeted ore purchase agreement at nearby Paddington mill for which there is an existing memorandum of understanding. The study targeted an initial (small subset of resources) 6.4 Mt @ 1.81 g/t Au for 0.34 Moz recovered, outlining a pre-tax NPV5 of A$203m at A$4,500/oz from pre-production capital of only A$14m (as ore is to be initially processed off-site Paddington mill in 2026 before a 1mpta is due to be constructed in 2027 for expansion capex of A$204m on existing mill site). BTR stock traded down -9% on 30 June (vs. gold developer median +0%), before closing the week (ending 4 July) down -4.1% (vs. group median up +1.7%) and month (ending 4 July) down +21.7% (vs. group median flat+0%) - perhaps because this study excluded much of BTR’s attributable resources amounting to more than 3Moz across the broader containing Menzies, Laverton, and Sandstone hubs making up this newer flagship project - most of which are left as future upside to supplement these study economics. BTR trades at market cap A$220m at A$0.47/sh and market cap/oz resource of US$44/oz Au - in between our 67-company gold developer group median and mean of US$38/oz and $65/oz AuEq (and a ~75% discount to where our intermediate gold producer median of US$177/oz - where BTR aims to graduate to with commencement of large-scale production by next year according to this DFS). On P/NAV (market cap/70% of reported pre-tax NPV), combining the company’s 2024 Scoping Study for other earlier stage project Jasper Hills and this DFS for Mezies/Laverton, BTR trades at 0.45x at 3-month trailing average US$3,270/oz - well above our gold developer mean of 0.16x at same gold price, but well below the ~1x range BTR is headed towards if it graduates to become a large-scale gold producer as planned.

30 June 2025 - Gold developer Barton Gold (ASX:BGD) announced a resource update for its South Australian Challenger gold project that grew project resources to 223 koz @ 0.72 g/t. The update focused on higher-grade tailings and open pit materials, and grew company wide South Australia resources by 9% to 1.90 Moz AuEq (98% from Au, rest Ag).

30 June 2025 (after-market) - Gold developer Barton Gold (ASX:BGD) announced the acquisition of the 279 koz for payment of A$5.5m made in 2 stages, including A$0.5m cash and A$5m in stock at a recent VWAP of A$0.78, in addition to a contingent benefit of up to A$9.5m in cash conditional on future gold production. The acquisition grows BGD’s South Australia resources by another BGD’s proforma shares now in include additional 6.4m pending shares for this transaction, for proforma shares of 229.6m. BGD stock closed week (ending 4 July) up +1.3% (in-line with group median +1.7%) and month (ending 4 July) +2.6% (vs. group median flat +0%) to proforma basic market cap of A$184m at 30 June closing price of A$0.80/sh, for a market cap/oz resource of US$55/oz (which has been slightly lowered from both this resource upgrade and acquisition) - in between our 67-company gold developer peer group median and mean US$38/oz and US$65/oz. Similarly on P/NAV (market cap/70% of reported pre-tax NPV), BGD trades at 0.19x according to results of its 2025 optimized scoping study for only its Tunkilla project (just above group mean 0.16x) - both at our recent trailing average gold price of US$3,270/oz, with a feasibility being completed this year and stage 1 production due as early as late 2026.

26 June 2025 - Gold explorer Tudor Gold (TSXV:TUD) announced further consolidation of its flagship Treaty Creek project (a large gold-copper porphyry in BC, Canada) through its acquisition of minority 20% project holder American Greek Resources (TSXV:AMK) in an all-share deal at an implied transaction value not far from AMK’s market price, which increases TUD’s ownership in this massive project to 80%. TUD’s attributable mineral resources increases by 25% to 26.5 Moz AuEq (80% basis). TUD stock was up intraday 26 June by +4% to C$0.51 following this announcement vs. AMK’s stock that had been flat +0% and our 88-company gold explorer median that had also been flat +0%, before TUD closed the week (ending 27 June) down -1.9% (vs. AMK down -8.3% and vs. our 89-company gold explorer median flat +0%), and the month (ending 4 July) down -1.9% (vs. AMK +33% and gold explorer peer group median flat +0%). On market cap/oz resource, TUD trades cheap vs. peers at US$5.2/oz at C$0.51/sh (and AMK trades slightly higher at $6.1/oz at C$0.12/sh), which is a wide 80% discount to gold explorer group median $25.4/oz AuEq.

4 July 2025

24 June 2025 - Former gold explorer - now gold developer - Snowline Gold Corp (TSXV:SGD) announced PEA results for its flagship 100%-owned Valley Gold project in Yukon, which reported a post-tax NPV of C$3.4b at US$2,150/oz from initial capex of C$1.7b. This project had been one of Canada’s major discoveries of the past decade, with the deposit beginning to take shape back in early 2022 on follow up drilling that returned intersections that included 1.01 g/t Au over 136.8m, 1.27 g/t Au over 108m, and 1.25 g/t Au over 168.7m, which ultimately led to a huge open pit resource estimate containing 8.83Moz Au (including high M&I share of 7.94 Moz grading 1.21 g/t Au). This top tier gold explorer had traded just above the upper quartile range of our gold explorer peer group on market cap/oz over much of past year, and now graduates to our gold developer peer group, and trades at a (4 July) market cap/oz resource of US$112/oz - a premium to our 67-company gold developer mean $65/oz - which appears justified due to SGD’s sheer size, strong economics with multi-billion dollar NPV, decent grade over 1g/t, but ESPECIALLY due to its SUPER LOW open pit strip ratio of 1.09:1 (waste:ore), which led to SUPER LOW LOM AISC of $844/oz ($569/oz in years 2-6) in this PEA, all of which was well received by the market on 24 June following this news (as we said it should an hour before market opened, here) when the stock closed 8% higher for the day (after some apparently mis-informed or un-informed investors/traders had initially sunk some ~half a million CAD trading the stock down to nearly -2% at the start of the day’s trading), before closing the week (ending 27 June) up +10.8% (vs. our 67-company gold developer peer group median of down -2.9%) and month (ending 4 July) up +6.6% (vs. gold developer median flat +0%). On P/NAV (taken as market cap/post-tax NPV), SGD now (4 July) trades at P/NAV of 0.47x (at our Reference gold price of US$2,000/oz) - a 16% DISCOUNT to our gold developer mean 0.56x (and above median 0.31x).

4 July 2025

4 July 2025

23 June 2025 - Gold developer Magnetic Resources (ASX:MAU) announced an updated resource for its Lady Julie project that grew it by 22% to 2.14 Moz, and grew combined Laverton Area (Australia) resources by 17% to 2.32 Moz - majority being open pit resources with solid open pit grades of 1.8-1.9g/t Au. MAU stock rose +0.7% on day of announcement (vs. our 65-company gold developer peer group median that had been flat +0%), before closing the week (ending 27 June) down -2.6% (vs. our 67-company gold developer median down -3.2%) and month (ending 4 July) down -14.9% (vs. group median flat +0%) at a market cap of A$425m and market cap/oz resource of US$120/oz - a substantial premium to gold developer mean $65/oz for this near shovel-ready, advanced-stage project with feasibility study underway for a ~2Moz open-pittable ounces grading near 2g/t Au (and PFS completed in 2024) with permitting advancing, making it an attractive take-out target for an intermediate gold producer, under which MAU’s resources could re-rate upwards to higher market cap/oz multiples (our 55-company intermediate gold producer group trades at median of $177/oz and mean of $270/oz). On P/NAV (taken as market cap/post-tax NPV), MAU trades at 0.37x - a premium to group mean 0.16x and median 0.10x (all at our estimated 3-month trailing average gold price of US$3,270/oz).

23 June 2025 - Gold developer Western Exploration (TSXV:WEX) announced an updated resource estimate for its Gravel Creek and Wood Gulch deposits - part of its 100%-owned Aura project in the top tier mining jurisdiction of Nevada. The upgrade grew inferred share of gold ounces by 56% while increasing grade by 9%. Overall (indicated + inferred) resource ounces grew by 20% to 1.46 Moz AuEq (90% gold by metal value, 10% silver). WEX stock traded down a slight -1.5% on 23 June intraday following announcement (vs. our 67-company gold developer group median that had been flat +0%), before closing the week (ending 27 June) down -13.4% (vs. group median down -2.9%) and month (ending 4 July) down -10% (vs. group median flat +0%) to a market cap C$33m and market cap/oz resource of US$16/oz AuEq - a ~58% discount to our gold developer group median $38/oz AuEq.

23 June 2025 - Gold explorer African Gold (ASX:A1G) announced a substantial update to its inferred resource at its flagship Didievi project in Cote d’Ivoire, which more than doubled contained gold to 0.989 Moz, grading high (for open-pits) at 2.5g/t Au. And the deposit has only been tested to ~300m depth, and excludes recent regional discoveries at Pranoi and Poku trends. A1G stock traded up +9.4% on 23 June following this news, before closing the week (ending 27 June) up +11% and month (ending 4 July) up +12% (vs. group median flat +0%) to A$0.19/sh to and market cap of A$97m (US$64m). On market cap/oz resource, these higher-grade open pit gold resources trade at US$65/oz Au, which is a slight premium to our 89-company gold explorer mean US$57/oz AuEq (and a larger premium to median $26/oz AuEq). And with resources approaching (a high-grade, open-pittable) 1Moz, economics for this project in a potential PEA scenario should be starting to look quite attractive.

4 July 2025

17 June 2025 - Silver explorer Kootenay Silver (TSXV:KTN) announced a maiden resource estimate for its 100%-owned Columbo silver project in Chihuahua, Mexico, which delivered a solid first pass of 54 Moz Ag grading on the high side at 284 g/t Ag (and 25 Mlbs Pb and 66 Mlbs Zn, low grade), in the inferred category. This grows KTN’s company wide resources by 20% to 339 Moz AgEq (3.5 Moz AuEq), with silver value share of this now increasing to 60% from 53%. KTN stock was down -6.7% on day of announcement (17 June) intraday TSX, before closing the week down -0.8% (vs. 19-company silver explorer group median -2.4%) and month (ending 4 July) up +20.6% (nearby triple the 22-company silver explorer group median gain of +7.6%), after rising some on news the upsizing of its bought deal public offering to C$17.4 million on 18 June that was due to strong investor demand. After dilution from the financing (for estimated pro-forma shares of 78.98m), KTN trades at a market cap of C$92m (US$69m) at C$1.17/sh and a market cap/oz resource of US$0.20/oz AgEq ($20/oz AuEq) - a ~42% discount to our 22-company silver explorer peer group median US$0.35/oz AgEq ($34/oz AuEq).

4 July 2025

13 Jun 2025 (after-market) - Intermediate gold producer, and now also silver producer, Dundee Precious Metals Inc. (TSX:DPM) announced an agreement to acquire silver producer Adriatic Metals Plc Metals (LON:ADT1), for consideration in cash and shares totaling US$1.3B or GBP 2.68 per ADT1 share, which is roughly a 9% premium over the GBP 2.45 per share range ADT1 has averaged close to over the week leading up to the announcement. ADT1 shareholders will receive 0.159 shares DPM and 93 pence in cash for each ADT1 share. The acquisition increases DPM's silver production, by adding 100% ownership of the Varvas silver-lead-zinc-gold mine in Bosnia and Herzegovina which recently declared commercial production with the mill reaching 90% of nameplate capacity or 2,000 tpd in June (and sustaining 80% of nameplate capacity for more than 7 days) as ADT1 announced on 1 July. The acquisition also comes with the Raška Zinc-Silver Project in Serbia. It is expected that DPM shareholders will own approximately 75%, and former ADT1 shareholders 25% of the DPM’s enlarged issue share capital, which we forecast from the terms provided will increase by ~33% to 223.607 M shares DPM (from 168.705M), with mineral resources growing by ~35% or by 392 Moz AgEq (4.1 Moz AuEq), with these added resources being made up 31% from Ag by metal value, 19% from Au, rest Zn-Pb-Cu, at a our estimated 3-month trailing average metal prices, to 15.5Moz AuEq (1.5 Boz AgEq) - with DPM’s Au share of overall resources to be lowered slightly to 69% (and Ag share up more significantly to 10%, which led us to now also add DPM to our silver producer peer group, which could have more upside if silver price continues to catch up to gold). DPM closed the week (ending 20 June) down -1.1% (vs. our -55-company intermediate gold producer median down -3.7%) and month (ending 4 July) down a slight -0.6% (vs. group median gain of +4.7%) to a pro-forma market cap of C$4.8b and market cap/oz resource of US231/oz AuEq (US$2.39/oz AgEq), as DPM’s strong cash-flowing assets trade at a 17% discount to intermediate gold producer group mean $270/oz AuEq (and at a small premium to its median $177/oz AuEq). ADT1 stock traded up +8.4% this past month (ending 4 July, in-line with silver explorer median performance of +8.4%, at GBP 270/sh and a market cap of GBP 345m (US$472m) and market cap/oz resource of US$1.23/oz AgEq ($1.19/oz AuEq) - a 30% discount to our 22-company silver producer median $1.77/oz AuEq (171/oz AuEq) - leaving room for these resources to potentially re-rate under DPM with its higher valuation multiples, especially as DPM’s new Varvas mine ramps up to 0.8 mtpa in back half of 2025, with future potential to go higher to 1.3mtpa.

16 June 2025 - Nickel (and now also gold) developer Lunnon Metals Ltd (ASX:LM8) announced results of a scoping study for its Lady Herald gold project in Australia, which presented un-discounted cash flows for the project (but excluded discounted cash flow and NPV info) yielding cumulative pre-tax CF of A$44.7M from minimal startup capital (initial capex reported to be a nominal ~A$1.2M for some roads etc.) and low AISC of A$2,100/oz, pending commercial agreement for off-site processing, which the study assumes will be reached with St Ives Gold Mining Company (SIGM) (see LM8 PR dated 21 March 2025). Processing costs for this scoping study were provided by SIGM, but are commercially sensitive and thus tentative. We now also add LM8 to our gold developer peer group given its recent focus on this Lady Herald gold project and given the state of the nickel market (despite lady Herald’s gold resources only accounting for 4% of LM8’s overall company mineral resources - with lion’s share 87% coming from nickel, at our estimated 3-month trailing average metal prices of US$3,144/oz Au and $7.15/lb Ni). LM8 stock traded up +2.4% following announcement (16 June) vs. Ni developer peer group median performance of flat +0% and gold developer median down -0.8%), before closing the week up +9.5% (vs. Ni developer group median flat +0%) and month (ending 4 July) up +14.4% (vs. group median flat +0%) at A$0.24/sh and market cap A$52m. LM8’s combined mineral resources of 288 Mlbs NiEq (0.66 Moz AuEq) trade at a market cap/lb of US$0.12/lb NiEq (US$54/oz), which is just above our 15-company nickel developer peer group mean of US$0.092/lb NiEq ($43/oz AuEq), and in between our 65-company gold developer peer group median US$38/oz and mean $65/oz AuEq.

4 July 2025

4 July 2025

11 June 2025 - Nickel and cobalt developer Canada Nickel Company (TSX:CNC) announced a large maiden resource for another one of its secondary projects, the 80%-owned Mann West project near Timmins, Ontario, which company says is the third of eight new resources to be published this year. The resource was significantly larger than the large initial resource for CNC’s flagship Crawford project (also near Timmins), which has since grown and had a feasibility study completed. The Mann West resource estimate was reported to contain indicated resources of 0.95 Mt Ni (2.1 Blbs Ni) grading 0.23% Ni and contains inferred resources of 1.3 Mt Ni (2.9 Blbs Ni). The estimate looks to grow CNC’s company wide resources by 12% to 37.2 Blbs NiEq (91% from Ni, 9% from Co, at our estimated 3-month trailing average metal prices). CNC stock closed the week (ending 13 June) down -14% following this news (to C$0.86/sh), and news of a brokered financing (later announced after-market 11 June) for up to C$8m (later upsized and closed at C$13m on 26 June), before closing the month (ending 4 July) down -3.3% (vs. nickel developer group median flat +0%). Including another 4.2m shares being issued for additional financing for C$4.5m initially announced 23 June for forecasted proforma basic shares of 212m, CNC trades at a pro-forma market cap per lb resource of US$0.004/lb NiEq ($1.72/oz AuEq) and a P/NAV (market cap/post-tax NPV from Crawford FS) of 0.056x (at our reference nickel price of $9.5/lb), resulting discounts of 91% and 41%, from our 15-company nickel developer peer group median market cap/lb of $0.042/lb NiEq ($19.7/oz AuEq) and median P/NAV of 0.09x (also at $9.5/lb Ni).

4 July 2025

4 July 2025

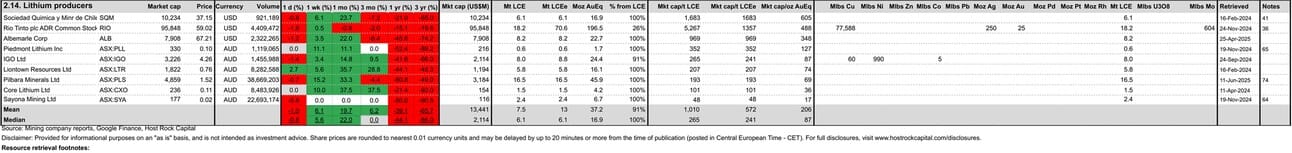

11 June 2025 - Lithium producer Pilbara Minerals (ASX:PLS) announced a mineral resource update for its main Pilgangoora project in Australia, that delivered a 23% increase to contained lithium for that project. PLS stock traded up +5.6% on 11 June, following this news (vs. 9-company Li producer peer group median +0.8%), before closing the week (ending 13 June) up 5.5% (vs. median +0.1%) and the month (ending 4 July) up +33% (vs. peer group median +22%) to A$1.52/sh and a market cap/t resource of US$193/t LCE ($69/oz AuEq) - now a widened 20% discount to Li producer peer group median $241/t LCE ($87/oz AuEq), and well below the ~$1,000-1,500/t valuation range of the major Li producers of the group (SQM, Albemarle, and Rio Tinto), making PLS an attractive, undervalued acquisition target for them (especially if Li prices start to rise from current rock-bottom low prices).

4 July 2025

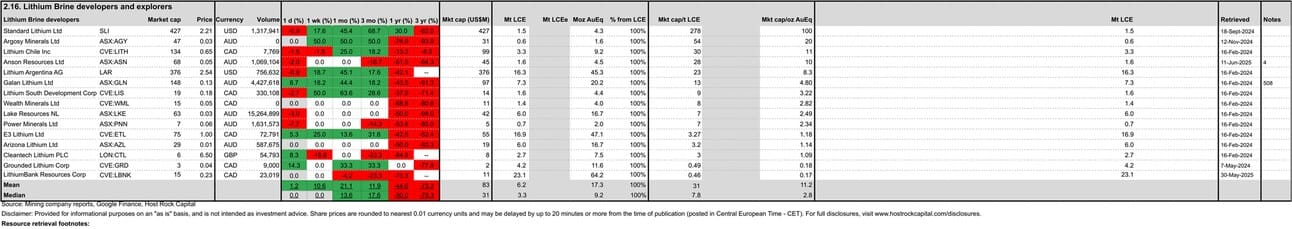

11 June 2025 - Lithium brine developer Anson Resources (ASX:ASN) announced a maiden JORC resource for its secondary Green River project SE Utah, USA, which is 40km away form its larger flagship Paradox project. Initial resources at Green River totaled contained lithium of 0.103 Mt LCE (grading 93.5mg/L Li), which increased company resources by ~6% to 1.6 Mt LCE, which closed the month (ending 4 July) at a market cap/t of US$28/t LCE ($10/oz AuEq) - a ~10% discount to our 15-company Li brine developer peer group mean of $31/t LCE ($11/oz AuEq) - despite the relatively advanced feasibility-stage of the company´s flagship Paradox asset (and potential synergies with this new nearby Green River resource), which is one of few projects that has a positive NPV at recent low lithium prices, with ASN trading at a P/NAV of 0.12x (in-line with median 0.12x) - both at our estimated 3-month trailing average lithium price of $9,099/t LCE. ASN stock traded flat on 11 June following this news (in-line with peer median of flat +0%), before also closing the week (ending 13 June) flat +0% (in-line with median +0%) before closing the month (ending 4 July) flat +0% (vs. peer group median gain of +13.6%) at A$0.049/sh and market cap A$68m.

4 July 2025

4 July 2025

9 June 2025 - Former lithium clay explorer, now lithium clay developer, Surge Battery Metals (TSXV:NILI) announced a PEA for its flagship Nevada North Lithium Project, delivering a huge after-tax NPV8% of a US$9.2B and (after-tax) IRR of 22.8%, at at Li price of US$24,000/t LCE, from initial (phase 1) capex of US$2.97B, which could become on the radar of the Trump Administration´s signaled support for domestic critical mineral production including lithium. NILI stock traded up +3.6% (to C$0.29/sh) during the week (ending 13 June) vs. 9-company Li developer peer group median down -2.9%, before closing the month (ending 4 July) down -16.7% (in-ling with group median -16.7%) to a NILI market cap of C$42m and market cap/t resource of US$6.6/t LCE ($2.38/oz AuEq) - in between our Li developer peer group median of $5.0/t LCE ($1.81/oz AuEq) and mean $9.26/t LCE (3.33/oz AuEq). On P/NAV (market cap/after-tax NPV), NILI trades at 0.004x - a 31% discount to peer group median 0.01x - all at our Reference lithium price of US$20,000/t LCE (assumed to correspond with a 20% higher $24,000/t lithium hydroxide for the case of NILI and others for comparison purposes).

4 July 2025

4 July 2025

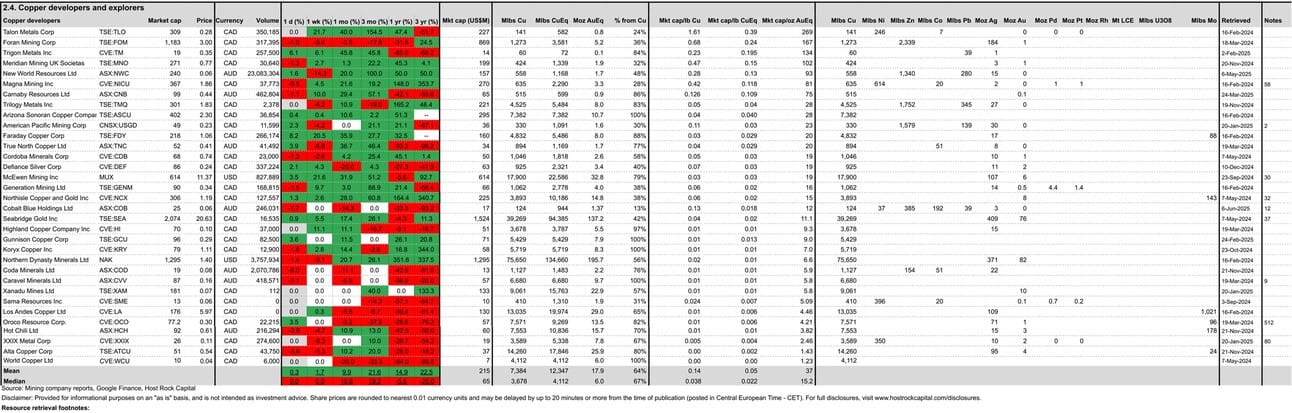

6 June 2025 - Cobalt developer, and now also copper (and zinc-silver) developer Cobalt Blue (ASX:COB) announced results of a Scoping Study for its Hall Creek Copper-Zinc-Silver project in Western Australia, which supplements a prior 2020 PFS for Broken Hill cobalt project, which had been more of a flagship in the past, but now this Hall Creek project appears more front and center for the company due to its exposure to rising metal prices for Copper and Silver (and Zinc which is also starting to inch higher - up 3$% over last month). The Scoping Study yielded a fairly solid post-tax NPV of A$121M and post-tax IRR of 21.4% at $4.55/lb Cu from capex of A$149.3M (which includes a 20% contingency and includes A$106.1M in underground mine development costs). COB stock traded down (on 6 June) -4.7% after this news (vs. our 31-company copper developer peer group median performance of flat +0% and our 9-company cobalt developer group´s +1.1%), before closing the week (ending 6 June) down -14.3% (vs. Cu developer median flat+0%), before closing the month (ending 4 July) down -14.3% (vs. cobalt developer median -2.4%). COB´s combined mineral resources from both projects total 928 Mlbs CuEq or 263 Mlbs CoEq (1.4 Moz AuEq), which are 73% from Co, 13% from Cu, 12% from Zn, rest Ag-Ni-Pb-Au, at our estimated 3-month trailing average metal pricing. These resources trade at a 4 July COB market cap/lb of US$0.018/lb CuEq or $0.057/lb CoEq ($12/oz AuEq) - now a 14% discount to our 31-company copper developer peer group median $0.021/lb CuEq ($13.8/oz AuEq) and a 7% discount to our 9-company cobalt developer median $0.061/lb CoEq ($13.1/lb AuEq).

4 July 2025

4 July 2025

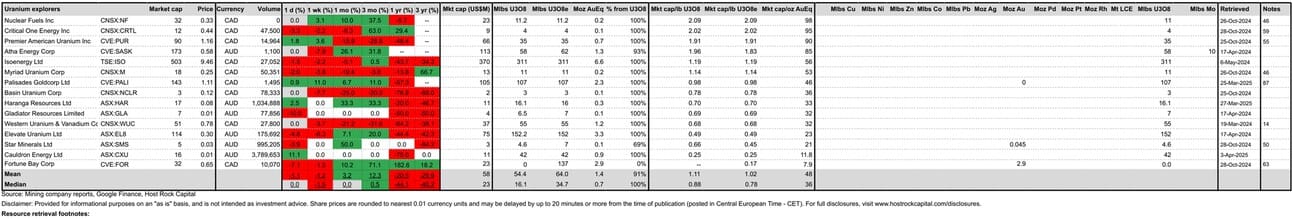

5 June 2025 - Uranium explorer Premier American Uranium (TSXV:PUR) announced acquisition of fellow uranium explorer Nuclear Fuels (CSE:NF), for implied consideration of C$0.43 per share, representing a premium of 54% to NF´s 4 June 2025 closing price, which will result in one of America´s largest pure-play uranium explorers with a proforma market cap of C$102M (as stated in the release, reported to be based on proforma shares at closing and PUR´s 4 June 2025 share price of C$1.31), which will be 59% owned by PUR shareholders and 41% owned by NF shareholders. NF´s projects host combined historic uranium resources of some 11.2 Mlbs U3O8 (across its Bootheel and Moonshine projects in Arizona and Wyoming), but this excludes its main Kaycee project, where a 2024 NI 43-101 exploration target of 11.5 to 30 Mlbs U3O8 was published. Any or all of these projects (along with PUR´s pre-existing projects in Wyoming, New Mexico, and Colorado) could benefit from the Trump administration´s signaled policy support for development of America´s domestic uranium resources. Pro-forma PUR mineral resources (including PUR´s pre-existing 23.5 Mlbs U3O8 and including NF´s historic 11.2 Mlbs, but excluding any exploration targets) are 34.7 Mlbs U3O8. PUR stock traded up slightly +0.8% (on 5 June) following this news while NF stock traded up substantially +27% (vs. uranium explorer group median performance of +1.9%), before PUR closed the week (ending 6 June) down -3.4% while NF closed week up +12.9% (vs. U explorer median’s +3.3%), before closing the month (ending 4 July) down -15.9% (vs. U explorer median flat +0% and NF gain of +10%), with PUR trading at a 4 July basic pro-forma market cap of C$90m and market cap/lb resource of US$1.91/lb U3O8 ($90/oz AuEq), apparently demanding a significant jurisdictional policy premium over our 15-company (soon to be 14-company) uranium explorer peer group´s mean market cap/lb of US$1.02/lb (with PUR´s mineral resources set to grow).

5 June 2025 - Gold, Nickel, and Cobalt explorer Nordic Resources (ASX:NNL) announced the completion of its acquisition of 3 Finland gold projects from gold explorer Northgold AB (formerly STO:NG) following NNL shareholder approval at an EGM held on 3 June 2025. Drilling is set to kick-off at these gold assets in July, following one other related NNL shareholder approval set for late June 2025, which is the approval the recently announced A$3.5 institutional placement. This follows a prior A$2.8M announced announced in April, together leaving the company cashed-up to take a meaningful step forward in growing & advancing its new flagship 0.81Moz AuEq Kospa project, along with 2 other resource-stage projects Central Finland - while also possibly making new discoveries across across its broader land package across the highly under-explored Middle Ostrobothnia, which already contains several targets requiring follow-up. NNL stock with it´s held resources of 5.8 Moz AuEq (15% from Au, 74% Ni, 7% Co, 4% Cu, at our estimated 3-month average trailing average metal prices), traded up +12.7% on 5 June following this news, before closing the week ending 6 June flat +0% in-line with gold explorer peer group median flat +0%, and closing the month ending 4 July up +12.5% (vs. gold explorer and nickel explorer peer medians both flat +0%) at a share price of A$0.085, pro-forma basic market cap A$29m (assuming forecasted pro-forma basic NNL shares outstanding of 323.2m upon closing of pending A$3.5M placement), and pro-forma market cap/oz resource of US$3.41/oz AuEq ($0.007/lb NiEq) which is 87% below our global 80-company gold explorer median $25.6/oz AuEq. And although we might expect NNL to trade at somewhat of a discount to gold explorer peers given the group mean´s gold share of resources is 88% versus NNL´s lower 16%, this valuation gap appears unjustifiably wide (not to mention this low gold share of resources is set to increase as NNL is now primarily focused on growing its gold assets)…We had previously (see LinkedIn post) suggested a more appropriate position for NNL in the market cap/oz pecking order might be the 13-percentile to 55-percentile range, especially as the ASX´s more global reaching pool of investors become aware of these newly acquired, attractive, near-development gold-copper assets, and have a chance to decipher their valuation vs. other ASX (and TSXV) listed peers, and especially as the potential/imminent cup-and-handle pattern plays out (that might be forming around NNL´s 200-dma around 9c/sh). This 13-percentile to 55-percentile range now (on 4 July) corresponds to market cap/oz range of roughly US$7.3/oz AuEq to $31/oz AuEq (or a 2.1x to 9.1x increase, to a NNL share price in the range of A$0.18 to A$0.77). Historical data point worth mentioning, is that these assets (when they were fewer and smaller) traded up to a market cap of US$80M which was the 71-percentile EV/oz range of NG´s combined gold explorer AND DEVELOPER peer group (of 32 peers it had considered relevant at the time), back in April 2022 following its Feb. 2022 IPO in Sweden.

Source: www.northgoldab.com (retrieved in April 2022)

3 June 2025 - Copper developer XXIX Metals (TSXV:XXIX) announced a newly tightened resource estimate for its Opemiska project in Quebec, which paves the way for an upcoming PEA for that project (XXIX already has a 2021 PEA for its other Thierry project). The large, open pit-constrained resource update resulted in a reduced surface footprint, and lower strip ratio through conversion of some waste zones to low-grade zones. The overall estimate grew contained metal just slightly, to a reported 69.65 Mt in the indicated category, grading 0.84% Cu, 0.31g/t Au, 1.82g/t, containing 1.3 Blbs Cu, 0.70 Moz Au, and 4.1 Moz Ag and 80.615 Mt in inferred category, grading 0.28% Cu, 0.17 g/t Au, 0.62 g/t Ag, containing 0.49 Blbs Cu, 0.43 Moz Au, and 1.6 Moz Ag. This grew overall company resources (including the company´s other projects/resources Thierry and Roger) by just under ~1% to 5.3 Blbs CuEq or 7.9 Moz AuEq, now 67% from Cu, 21% from Au, rest from Ni, Ag, Pd, Pt (at our estimated 3-month trailing average metal prices). XXIX stock traded down -12% (on 3 June) intraday following this news (vs. copper developer group median performance of flat +0%), before closing the week (ending 6 June) down -7.7% (vs. peer median flat +0%) and month (ending 4 July) flat +0% (vs. group median monthly gain +10.4%), to market cap C$26m and market cap/lb resource of US$0.004/lb CuEq ($2.46/oz AuEq) - a wide 84% discount to our 33-company copper developer peer group median of $0.022/lb CuEq ($15.2/oz AuEq). On P/NAV (taken as market cap/post-tax NPV), including only the 2021 PEA for Thierry (which will soon be supplemented by another PEA for Opemiska), XXIX trades at 0.11x - a 61% discount (was 46% discount on 3 June) to our copper developer peer group median 0.29x (was 0.21x on 3 June), both at our Reference copper price of $3.5/lb.

Disclaimer: Provided for informational and educational purposes, and is not intended as investment advice. Host Rock Capital and its closely-related parties hold stake in Nordic Resources (ASX:NNL). For full disclosures, visit www.hostrockcapital.com/disclosures.